There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

Melbourne property prices: Will they continue to rise? Five economists predict

It may be the most livable city in the world ( 7 years in a row in fact) but it’s also become a challenging city to buy a property in.

So what can we expect from the Melbourne property market?

An article on Domain.com.au looks at what five top economists have to say.

Melbourne’s property price growth is among the strongest in the country, but economists are split on what prices will look like next year.

Domain asked five top Australian economists to provide their forecasts for price growth over the next 12 months – and the results were surprising.

For houses it seems the boom is yet to run its course, with the overwhelming majority of experts anticipating continued price growth.

But the big question mark hangs over the future of apartments.

There was little consensus about what that trajectory might look like for this part of the property market – with expectations ranging drastically for 2018’s unit outlook.

… it appears as though the long-overdue cooling in Sydney and Melbourne is poised to happen – Stephen Koukoulas, Market Economics

The panel

- AMP Capital chief economist Shane Oliver

- Market Economics managing director Stephen Koukoulas

- Compass Economics chief economist Hans Kunnen

- BIS Oxford Economics managing director Robert Mellor

- Domain Group chief economist Andrew Wilson

House price outlook

- Four expect prices to increase.

- One expects prices to remain flat.

- Highest outlook: prices up “5 to 10 per cent”

- Lowest outlook: no growth

The one point all the experts surveyed agreed on was that Melbourne houses would not fall in price in the 2017-18 financial year, though Market Economics managing director Stephen Koukoulas did not expect any growth.

Mr Koukoulas anticipated a slowdown 12 months ago, which didn’t eventuate.

But he was not alone in his predictions then, with many seasoned experts anticipating the end of the boom.

With a crackdown on demand-side pressures — including higher interest rates for investors and interest only loans — and rising supply, Mr Koukoulas is confident the market will flat line now.

Even experts forecasting growth for this market were not expecting to see anything near the conditions of the year to June 2017 again when prices jumped 15.1 per cent.

For the four experts anticipating more upwards price movement, forecasts ranged from 2 per cent, as tipped by AMP Capital’s Shane Oliver, all the way up to nudging 10 per cent.

Melbourne’s median house price could be anywhere from about $866,000 to $935,000 by mid-2018 on these measures.

Compass Economics chief economist Hans Kunnen anticipated a strong growth trajectory for Melbourne in the bracket of 5 to 10 per cent due to strong population growth and economic activity.

“Interest rates are not expected to rise and current APRA [Australian Prudential Regulation Authority] regulations seem to have stemmed the excesses of investment lending,” he said.

Domain Group chief economist Andrew Wilson pointed to a “raft of predictions of doom and gloom for Melbourne this year that have proven nonsensical” but he didn’t anticipate any double digit annual growth figures in the near-future.

The panel was less certain about what would happen in the apartment market.

Apartment outlook

- Three expect prices to fall.

- Two experts predict prices to grow.

- Highest outlook: prices up “5 to 10 per cent”

- Lowest outlook: price falls of 5 per cent

Both Dr Oliver, Mr Koukoulas and BIS Oxford Economics managing director Robert Mellor expected unit prices would decline.

And if these predictions pan out, it could leave Melbourne’s current median apartment price of $474,848 dropping to anywhere between $451,106 and $465,351 by June 2018.

The most bearish predictions came from Dr Oliver, who said his outlook of a 5 per cent fall was based on unchanged interest rates for the next 12 months, but a likely increase of 25 basis points for bank mortgage rates on interest-only loans for investors.

Read the full article here

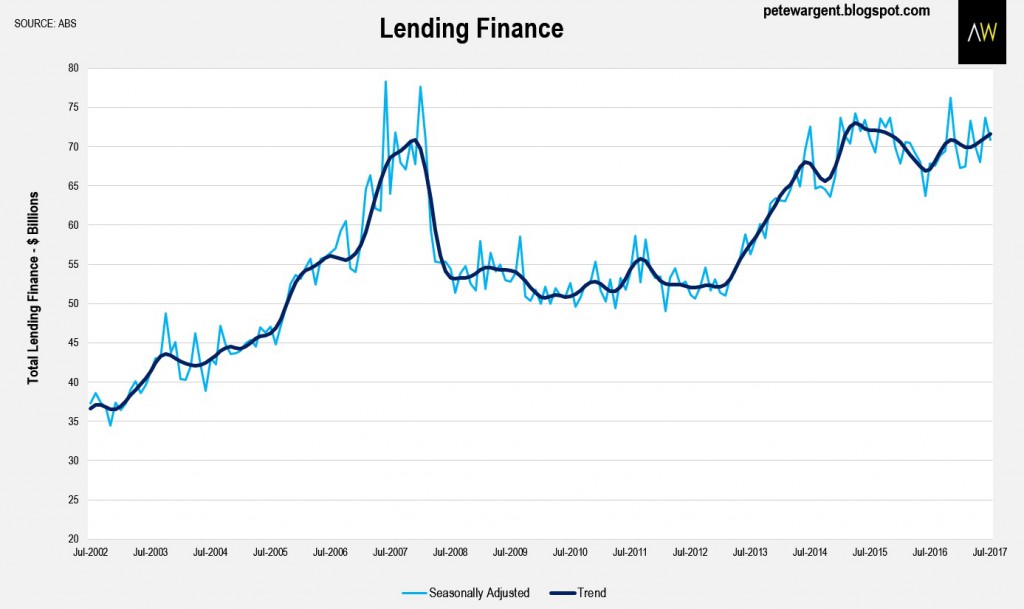

Lending finance picks up

Despite a turbulent year – it would seem lending finance has taken a positive turn.

This Blog by Pete Wargent shows the statistics behind the results.

Having a lend

Lending finance was shaping higher again by July, back up to $71.6 billion in trend terms, to be +6.7 per cent higher than a year ago, and getting pretty close to the highs of 2015.

Commercial lending to businesses picked up, which is generally seen to be a good sign, while housing lending to owner-occupiers hit a record high.

Personal lending commitments are tracking back down at levels not seen since 2002.

Read the full article here

Australia’s housing market is cooling down, but there’s no sign it’s anything more sinister than that

It would seem that not a day goes by where we’re not bombarded by an ‘economic collapse’ headline.

But is it all really that gloomy?

An article from Business Insider looks at the what’s really going on in the Australian housing market – and puts some of those ‘dramatic’ headlines to rest.

Whether measured by auction clearance rates or price growth, Australia’s housing market is starting to slow down.

But, as yet, it’s nothing more sinister than that.

According to data released by CoreLogic today, a preliminary clearance rate of 71.7% was recorded across Australia’s capital cities last week, marginally higher than the 70.5% preliminary reading reported one week earlier.

The preliminary reading points to the likelihood that the final clearance rate for the week, released on Thursday, will sit in the high 60% region, continuing the pattern seen since the start of June.

The final clearance rate for the week ending August 13 stood at 67.5%.

Source: CoreLogicAfter recording its first sub-70% reading since July last year, Melbourne’s high-flying housing market returned to form last week with a preliminary clearance rate of 77.7%, the highest of all Australian capitals.

Sydney, at 70.8%, also put in a reasonable showing, although it still remains well below the levels seen at the start of 2017.

Both cities recorded final clearance rates of 69.8% and 67.6% in the previous week.

Of the smaller capitals, clearance rates improved week-on-week in Brisbane, Perth and Hobart, but fell in Adelaide and Canberra.

CoreLogic said that auction volumes were almost unchanged from a week earlier, although they remained significantly higher than the same period a year earlier.

“There were 2,041 capital city auctions this week, virtually unchanged from last week’s 2,040 auctions as well as being higher than the 1,795 auctions held one year ago,” the group said, adding that “volumes continue to track higher than what was seen over the corresponding July-August period last year”.

In Melbourne and Sydney, Australia’s largest auction markets, volumes increased in Melbourne but fell in Sydney compared to a week earlier.

Read the full article here

How many properties does it take to retire comfortably?

We all want to know that our financial future is secure – so what does it really take to make that happen?

This article from News.com.au looks at just how many properties it would take to retire comfortably.

WHEN it comes to real estate investors, those with multi-property portfolios aren’t that common, but it’s just as important to know when to stop as when to start.

According to CoreLogic analysis of ATO and ABS data, just over two million Australians held an interest in an investment property in 2015.

Of that two million, 71.6 per cent had just one property, while just 18 per cent held two.

From there the numbers continued to drop dramatically to the point where investors with six or more totalled a minuscule 0.9 per cent of the investor population — or just over 19,000 people.

But those 19,000 Australian are onto something according to Destiny founder, Margaret Lomas — as long as they know when to stop.

According to Ms Lomas, a portfolio of seven properties is enough to provide a comfortable retirement.

“It’s really a value more than a number, but because people like numbers, I always think seven is about it — but we’ve got to understand how that seven then rolls out over a lifetime,” Ms Lomas said.

Ms Lomas said if you have the means to buy seven properties in one go, then good on you, but the vast majority of investors need long-term plans.

“If you’re like the normal, everyday person, you’re going to start with one and it’s going to take you a couple of years before you’re ready to buy a second,” Ms Lomas said.

“They might reach the fourth year with three (properties) and then by the time they get to year five and six, they’re at that point where they probably can buy two at once, and they’ve got more of an appetite for risk,” she said.

“To have a $100,000-a-year lifestyle, your need to have a clear (debt free) $2 million worth of property.

If you’ve bought seven and you’ve given those 15 years (growth), there’s a chance you’re going to get there, but I don’t want people thinking they’re going to make millions and millions out of property very quickly, because it doesn’t happen that way,” she said.

Ms Lomas said investors are sold the mindset to own more than this by ‘advisers’ with vested interests.

“I blame the spruikers for that because obviously it’s in a spruiker’s best interest to have a client come on board and buy as many properties as they possibly can, and we all know a spruiker will make their money out of a property sale,” Ms Lomas said.

“For every sale that goes through, they’re probably in for (commissions of) anything between $20,000 to $40,000, and the more they can get a particular client to buy, the more that client is worth to them over their lifetime,” she said.

GROWTH OR CASH FLOW?

Ms Lomas said forget about the capital growth vs. cash flow debate when selecting an investment, because you can have both.

She said look for areas with price-growth drivers like infrastructure development, increasing numbers of families, diversity of industry for jobs and limited development to keep supply down.

“Your aim as an investor is to spot growth drivers.

Once you’ve done that, you’ve got to find the kind of property in that area that’s going to appeal to both buyers and renters,” she said.

Ms Lomas said over the long-term, the right properties will see good growth and achieve a comfortable five per cent yield to help service the debt.

GOT THEM! NOW WHAT?

Ms Lomas said once you’ve acquired the investments, hold off on action for as long as possible.

She said smart investors will even use their superannuation first in retirement so the portfolio has more time to rise in both rent and value.

“When you get to the point where your superannuation is starting to wear a little thin, then your property should be good to go,” she said.

Ms Lomas said, depending on circumstances, you can either live off your portfolio’s positive rental income, or choose to sell down some holdings to reduce the debt on others which boosts your total returns.

Read the full article here

How To Nail A Job Interview

What does it really take to nail a job interview?

Is it your appearance? Your resume? Or you research abilities?

According to an article in The Huffington Post it’s a collection of factors – keep reading to find out what they are.

No matter how confident you are you’re right for the job, mucking up the interview process could see you catapulting back to Seek in no time.

Which is a bummer, because finding your dream job can be hard enough at the best of times, and to be granted an interview is to say you’re in with an actual chance of landing it.

So how do you ensure you nail your interview and walk away with the gig?

HuffPost Australia spoke to people leadership expert Karen Gately to find out.

How important are first impressions?

“I think they are actually incredibly important, because as human beings our brains are wired to determine what is good or what is bad, to put it that simply, in the first instance,” Gately said.

“Everything about us is wired to make judgment calls in a very short period of time.”

Meaning how you look, talk and behave is all going to factor into whether or not you succeed, and it starts from the word go.

What should I wear to a job interview?

“You need to think about the audience and what sort of organisation you are going to,” Gately said.

“It’s important to have appreciation for their cultural environment and what the acceptable standard of dress is for them. Find out as much as you can, and do what you can to match it.

“But really, at the absolute minimum, if you are going to a family function or a function where there will be people you have a lot of respect for, you wouldn’t arrive like a slob. It’s a good rule of thumb to abide by.”

How early should I be?

“Always arrive 10 minutes before your interview, because it says, ‘I’m here, I’m ready to go when you are. I have planned to be here on time and have allowed room for error,” Gately said.

“In saying that, there is a thing as being too early. You don’t want to be there for so long they feel they have to entertain you.

What do I do if I’m running late?

Of course, despite our best intentions, sometimes life can get in the way and muck up our plans regardless. Gately’s advice?

“You phone, you don’t text, as a starting point,” she said. “A candidate did to my client last week. I was like really!?

What should I say when I’m asked about my weaknesses?

Ugh. The dreaded question.

“My first bit of advice is don’t say ‘I’m a perfectionist’. It annoys just about everybody who interviews people,” Gately said.

“I can tell you right now they’re going ‘yeah, yeah, you and everybody else.’

What do I do if a question is inappropriate?

“Okay, so that is a judgment call. If they ask you a question that is unlawful — and the classic example of this is asking when are you planning on having kids — then in my own circumstances I would choose to walk away from a job opportunity than work for an employer willing to discriminate against me. But that’s just me,” Gately said.

“Of course, there are different circumstances. For instances sometimes people can just ask really dumb questions and it’s ignorance as opposed to trying to be discriminatory.

How do I stand out from the crowd?

If you think there are likely to be lots of candidates vying for the same role, you might want to think of ways you can stand out. But Gately warns it really isn’t a one-size-fits-all kind of policy, and you will need to do your homework beforehand.

Can you ever be too prepared?

According to Gately, the answer is no. But you can be too scripted.

“You can’t be too prepared, but you can be too rehearsed. It’s one thing understanding the company and the role but if you are going to end up sounding like a robot, maybe put the books down and go with the flow a little bit.”

Is it OK to follow up on a job interview?

Not only is it okay, it’s encouraged.

“You should definitely follow up and you will get varying degrees of quality feedback,” Gately said. “If you are still going through the process, you can ask for feedback to prepare for the second round.

“It’s perfectly fine to say ‘I’m just asking for some insights so I can reflect on for being well prepared for next time’.

What are the worst things someone could do in a job interview?

“Don’t ever, ever put your mobile phone in the middle of the table in preparation for a phone call,” Gately said. “I’m telling you because a guy did this to me, and when his phone rang, he answered it.’

“But other things to steer clear of are swearing — it’s just not worth it. Even if they are swearing, it’s a risky place to go. It might seem as though you are getting a bit too familiar.

How do I deal with nerves?

“My attitude toward this is this: if you have put your hat into the ring and you are stepping forward for a job interview, you can choose to believe you are great candidate. So often we spend so much time obsessing over all the reasons they might reject us and why we might not get the job, and so little time thinking about why we are right.

Read the full article here

No comments:

Post a Comment