Think those outer affordable suburbs are going to become the new “it” locations?

Well, you probably need to think again…

You see, there are many reasons why outer suburbs remain more affordable than the inner-city.

Don’t believe me?

Let’s take a look at some facts and figures to back up my statement.

Mortgage pain

With higher property prices in Sydney and Melbourne, you’d expect that mortgage stress was higher, too, wouldn’t you?

But that’s not the case.

In fact, an analysis of data from the past two censuses found that fewer households were experiencing mortgage stress, which is defined as spending 30 per cent or more of household income on home loan repayments.

In 2011, about 10 per cent of households had mortgage stress but in 2016, it was only seven per cent.

Prices increased significantly in Sydney and Melbourne over that five-year period, but fewer people are struggling to pay their mortgage.

How does that make sense?

The secret is, in part, due to lower interest rates.

It’s actually easier for people to pay their mortgages today because of historically low interest rates.

But this is but a moment in time…

Interest rates will rise in the future, plus we’re experiencing flat wages growth as well.

This means some borrowers might not be able to afford their loan repayments in the years ahead, especially if they have taken on large mortgages that they can’t really afford.

What it boils down to is that when this mortgage stress starts to bite, it’s much more likely to happen in the outer suburbs, which are predominantly the domain of young families and blue collar workers where wages have grown the least.

Conversely, many people who are employed in service industries have enjoyed better wages growth and usually live in the inner- and middle-ring suburbs because they can afford to do so.

Stressed out suburbs

Let’s take a look at some mortgage stress data to illustrate, shall we?

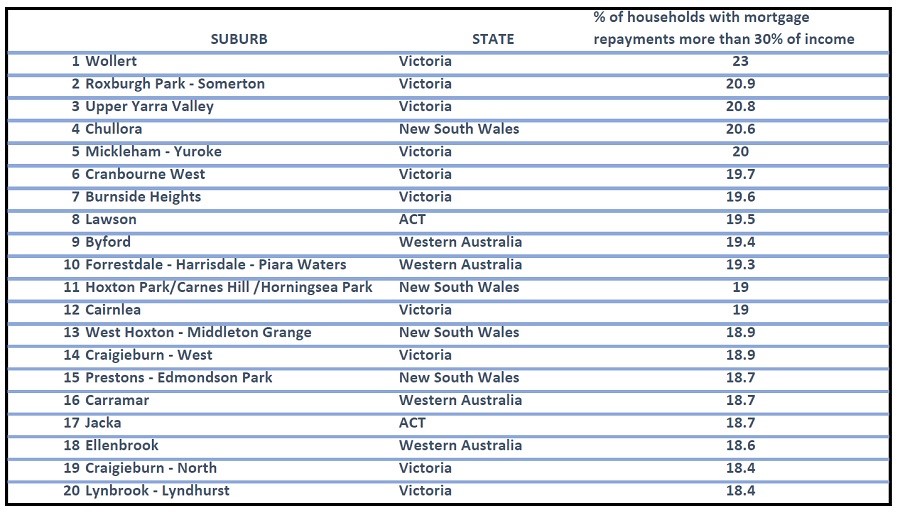

Half of the top 20 suburbs in Australia that are under mortgage stress are in Victoria, which is a “serious problem”, according to a report by the Grattan Institute.

The report’s data, which comes from the last two censuses, found Wollert, which is about 27 kilometres north of Melbourne’s CBD, has the highest percentage of houses under mortgage stress in the nation, at 23 per cent.

Let’s take a look at the top 20 results around the country.

Source: Grattan Institute / Business Insider

Do you see any trends amongst the results?

Outer suburbs are where mortgage stress hits the hardest.

And when that happens, prices fall as struggling homeowners bail out before the banks step in and take over.

What’s also concerning is that other Grattan research found that if interest rates went up two percentage points, which is possible over time, stress levels would be the highest on record – apart from the squeeze in 1989, which scarred a generation of home-owners.

The bottom line….

As our markets are in the more mature stage of their cycles, especially in Melbourne and Sydney, property selection is more critical than ever for investors.

Let me be clear: some properties will suffer more than others when interest rates eventually rise.

And these properties will generally be located in outer suburbs which are more sensitive to interest rate increases.

But it’s not just the affordable end of the market that is likely to feel the pain.

The upper end of the market is likely to suffer, too.

After all, you don’t need a $5,000,000 home when your $3,000,000 home will do nicely.

It’s also no coincidence that when rates ramp up it’s those house and land package areas – so new estates and off the plan properties – that will also suffer as first homebuyers and investor demand subsides.

What it boils down to is that investors must concentrate on buying superior properties.

That means buying in the gentrifying, more affluent, inner- and middle-ring suburbs of our big capital cities.

The thing is that regardless of what interest rates, or what the market does, people are still going to get married, divorced and have babies.

Life will go on, some jobs will still pay well, and demand for well-located investment grade homes and apartments will continue to underpin property values.

If you stick to those fundamentals, then your investment strategy will continue to outperform the averages.

No one aims to be “average” do they?

![[Imported] WP Advertize it Free Strategy ad 10 July 2014 (Desktop #44800)](https://propertyupdate.com.au/wp-content/uploads/2014/07/m-propertyinvestors-18July2014.png)

No comments:

Post a Comment