This month CoreLogic will focusing on how the housing market has tracked through to the end of May as well as taking a look at factors that are placing downwards pressure on housing market activity and dwelling values.

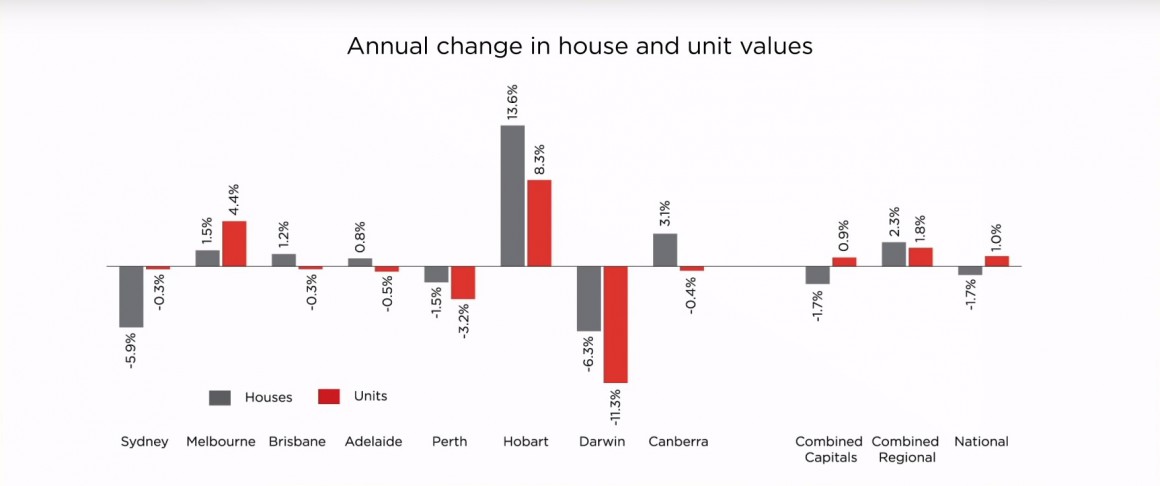

Australian dwelling values slipped 0.1% lower in May, taking the annual change, at negative 0.4%, into negative territory for the first time since October 2012.

In a sign that the housing market is becoming more entrenched in a downturn, May marked the eighth consecutive month-on-month fall since the national market peaked in September last year taking the cumulative decline in dwelling values to 1.1% through to the end of May 2018.

The negative headline growth rate is attributable to weakening housing conditions across the capital cities, led by Melbourne and Sydney, where previously capital gains were nation-leading.

Sydney and Melbourne comprisr approximately 60% of Australia`s housing market by value, and 40% by number, so the performance of these two cities has a larger effect on the headline market performance.

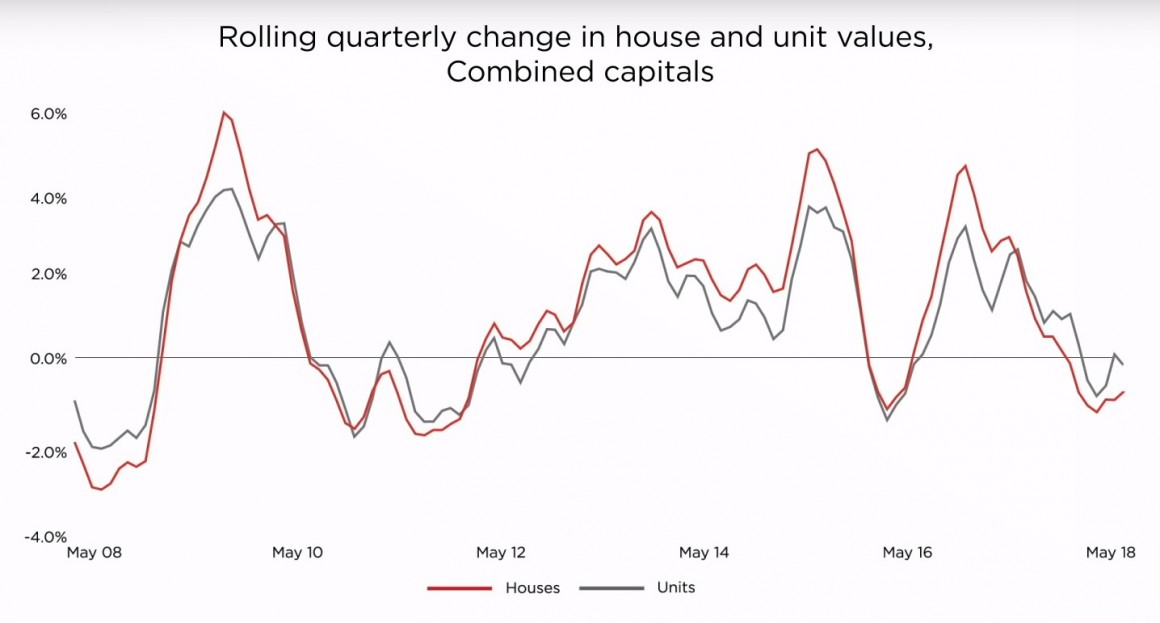

With housing affordability remaining a challenge in the largest cities, demand is naturally transitioning to the medium and higher density sector, where the market entry point is typically more affordable and housing stock is often more strategically located along transport spines and close to major working nodes.

This broader demand base has seen unit markets in Sydney and Melborne outperforming the detached housing sector, despite the significant number of units that been built over recent years.

Most other cities, where affordability constraints aren`t as pressing, continue to see house values outperform the unit sector.

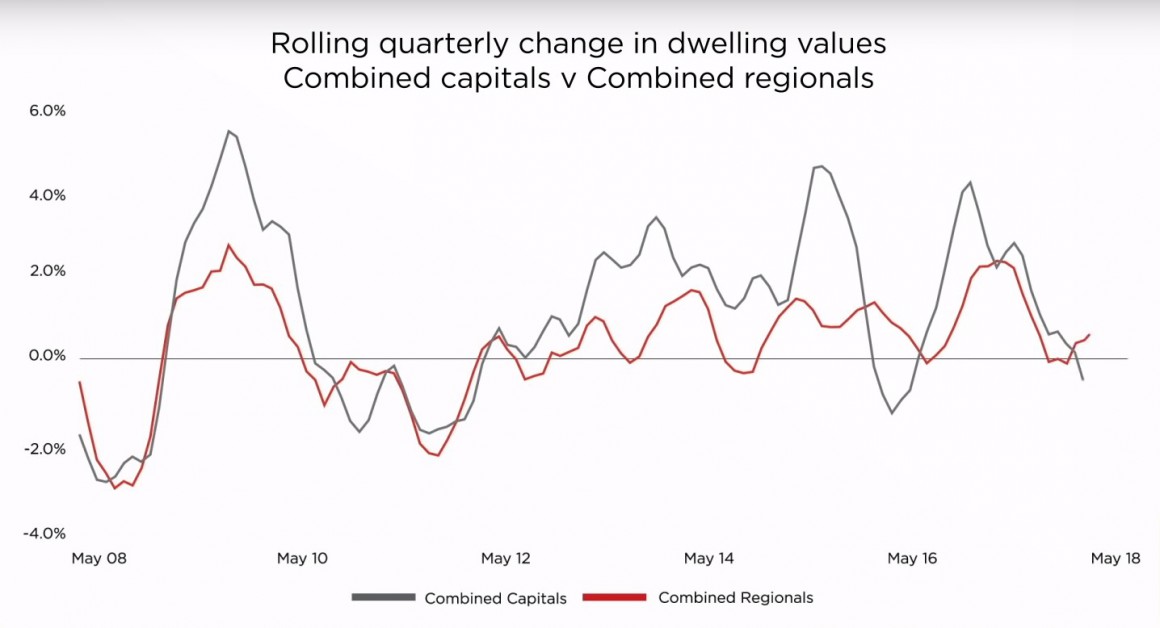

The combined regional markets have helped to offset a broader decline, with dwelling values consistently rising outside of the capital cities, albeit at a much lower pace relative to the growth seen in Sydney and Melbourne over the previous growth phase.

The combined regional markets index nudged 02.% higher over the month to reach a new record high in May.

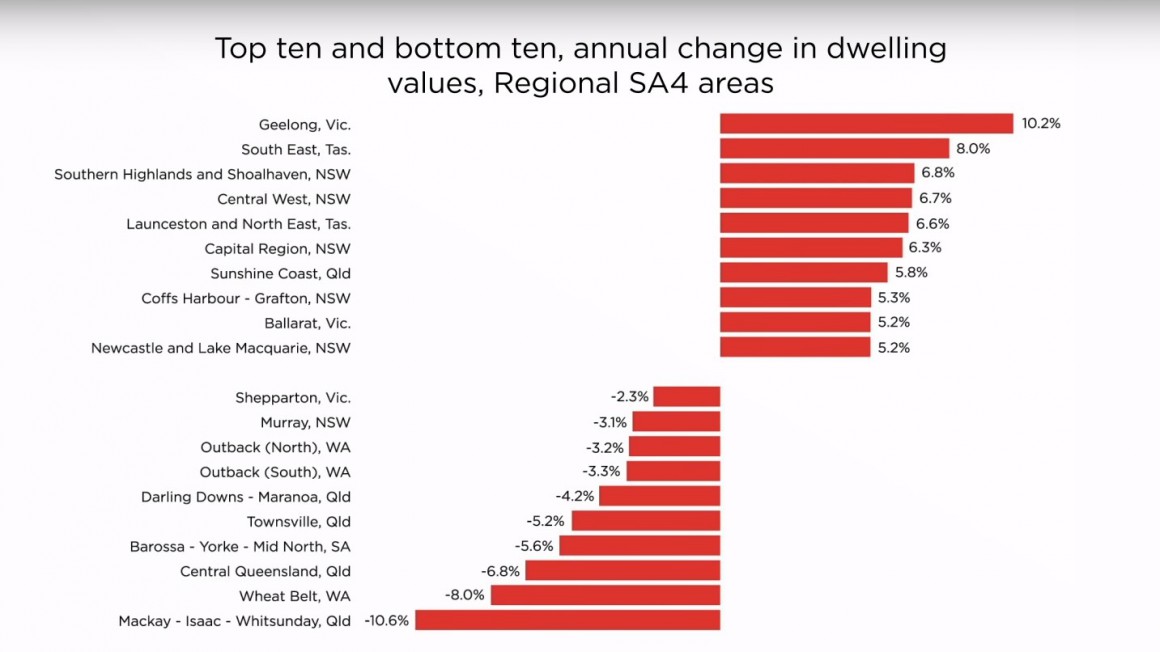

Across the regional markets, Geelong maintained its position as the best performing area outside of the capital cities with dwelling values up 10.2% over the past twelve months.

Across the top ten performing regional markets is a mix of satellite cities such as Geelong, Ballarat and Newcastle, as well as lifestyle markets such as the Sunshine Coast, Southern Highlands in NSW, Shoalhaven and Coffs Harbour.

Regional housing trends are also now seeing less drag from the mining regions.Although the weakest performing areas are generally still linked to the mining and resources industry, the declining trend has eased off actually even levelled across many of these markets.

Apart from our hedonic indices, a wide range of other measures provide further evidence of weakening housing markets.

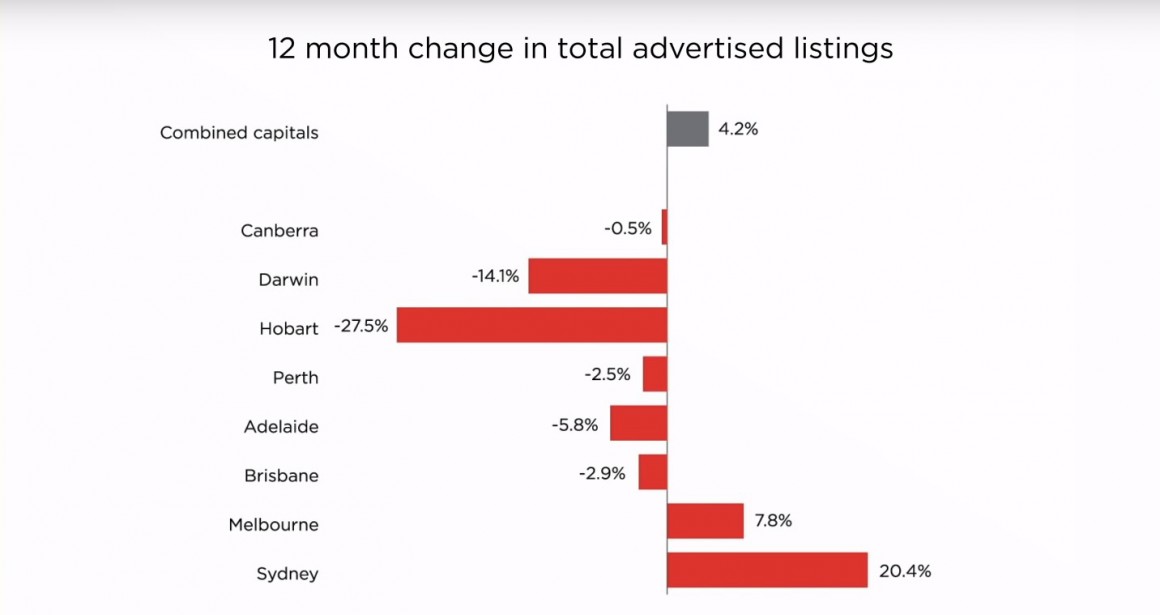

Advertised stock levels have been trending higher across the capital cities, up 4.2% on a year ago, once again being driven by Sydney, where advertised listing numbers are 20.4% higher than a year ago, and Melbourne, where stock levels are almost 8% higher.

Every other capital has seen an overall reduction in advertised listing numbers.

Every other capital has seen an overall reduction in advertised listing numbers.

More listings in the market means more choice and less urgency for buyers.

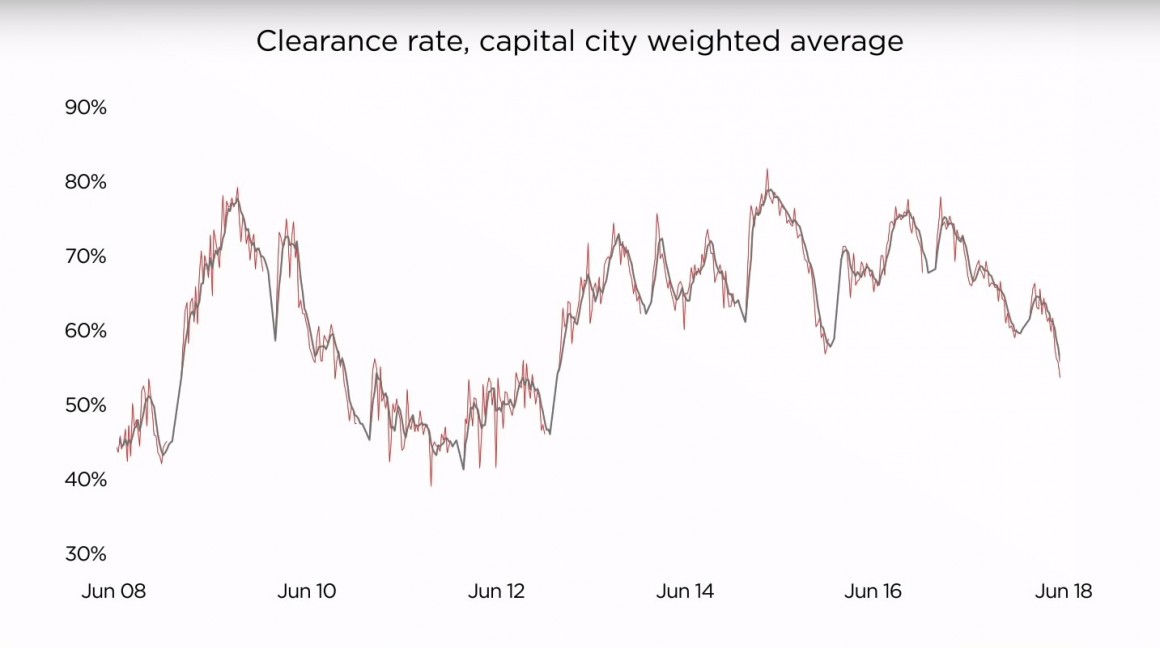

This lack of urgency is also evident in auction clearance rates which have consistently trended lower since the middle of last year.

Over the first week of June, Sydney`s auction clearance rate dipped below 50% for the first time since 2012 and Melbourne`s clearance rates have fallen below 60% for the first time since 2014 over recent weeks.

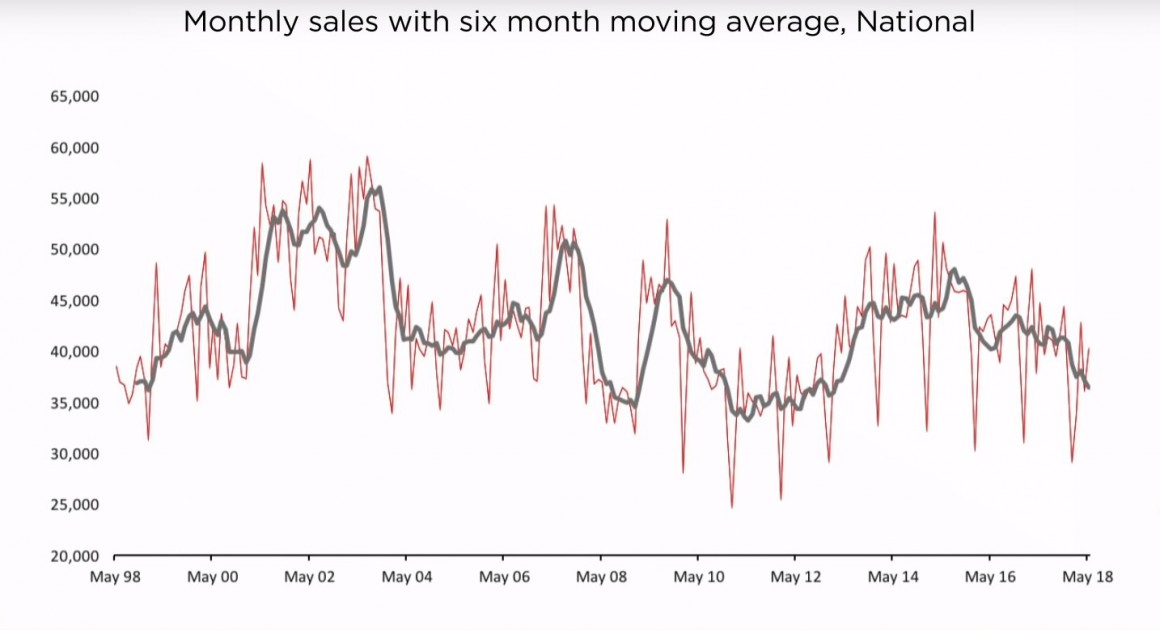

Transaction volumes have continued to trend lower, with CoreLogic`s estimate of settled sales tracking 7.7% lower year on year.

While this figure will revise higher as off the plan unit sales move through to settlement, it`s clear that market activity hs reduced substantially since the first round of marco prudential policies was announced in December 2014.

No comments:

Post a Comment