Although “overall”property prices recently fell for the first time over any 12-month period since 2012, leading economist Shane Oliver believes a property crash is unlikely.

Over the years there has been talk that the Australian housing market is a giant speculative bubble propelled by tax breaks for greedy property investors, low interest rates fuelling speculation and Australians overcommitting themselves financially with “liar loans” which will lead to massive mortgage stress that will bring down the banks and our economy with it.

Australians overcommitting themselves financially with “liar loans” which will lead to massive mortgage stress that will bring down the banks and our economy with it.

The recent fall in national prices was driven by a drop in Sydney prices values and the recent drop in property values in Sydney has brought with it a slew of spectacular headlines.

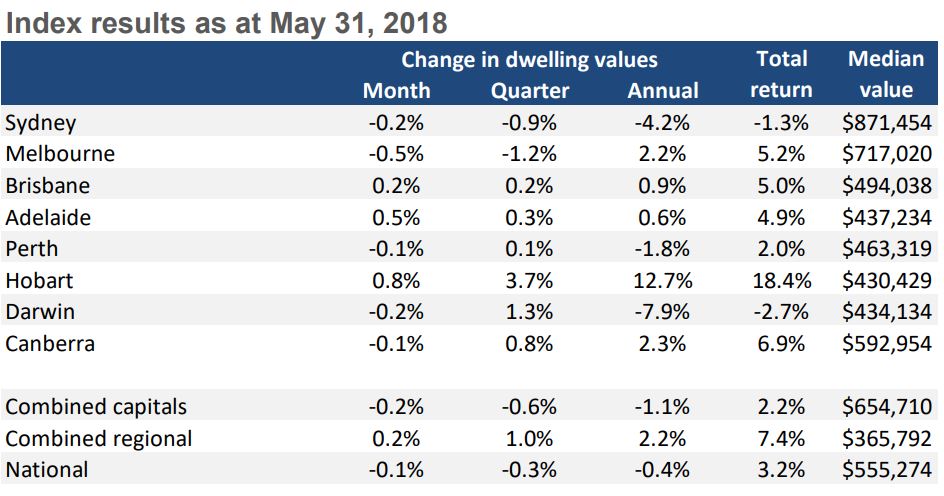

But when you look into it more carefully national property prices dropped 0.4 per cent for the year ended to 31 May 2018, according to data from property analytics group Core Logic.

Sure this is the first time there has been an fall over any twelve month period since October 2012, but that’s not the stuff that makes property markets crash.

So what is a property crash?

There is no doubt the Sydney and Melbourne property markets did get a bit bubbly and therefore we are going to go through a pretty weak patch in those two cities, but we don’t see a property crash according to Shane Oliver, chief economist at AMP.

He says a property crash should be defined as a situation where prices come off 20-25 per cent on average, not just in one suburb or one house but across the market.

And Oliver does not see that happening for several reasons.

The first is that for that to occur, you would expect to see Australians forced out of their homes en masse; and for that to happen you would have to see much higher interest rates or much higher unemployment, and I just don’t think we are going to see that.

The Reserve Bank of Australia is not likely to raise rates until at least 2020 and the next move being a cut cannot be ruled out.

Oliver says what we will see though is ongoing weakness in the Sydney and Melbourne property markets over the course of the next couple of years.

Oliver thinks prices are going to come down on average by 15 per cent from top to bottom of which they have already fallen 4 per cent or so.

Some areas a little bit more, some areas a little bit less, particularly as tighter bank lending standards continue to impact.

The Australian Prudential Regulatory Authority has asked banks to strengthen lending standards around borrower’s income and expenses and limit loans to high debt to income borrowers.

That combined with the likely transfer of interest-only loans to principal and interest loans going forward could pressure the property market further.

Looking across the rest of Australia though, the outlook is a mixed bag.

Oliver believes that house prices in Darwin and Perth look like they are starting to bottom out after going through several years of price weakness.

Elsewhere Oliver believes we are looking at moderate gains.

Places like Canberra, Brisbane, and Adelaide didn’t experience anything like the boom that Sydney and Melbourne had, and therefore they are not going to have the same downside according to Oliver.

Likewise, Hobart is still doing really well.

Oliver don’t see a property crash unless we get much higher interest rates or much higher unemployment and that’s not really on the cards

No comments:

Post a Comment