There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading.

A new Australian dream: Why Melbourne and Sydney need to be more like New York

The Great Australian Dream has certainly undergone some changes – particularly with the changes to the property market.

So what is the new dream and what should change?

An article on Domain.com.au looks at the what Sydney and Melbourne can learn from New York as the market continues to evolve.

With Melbourne and Sydney expected to grow to the size of New York City by 2050, urbanists have warned Australia’s rapidly-growing capital cities face catastrophic failure unless they densify and start looking a lot more like the Big Apple.

To see how urban renewal can help accommodate Australia’s soaring population, more than 40 delegates from Australia’s property industry travelled to New York for a week-long study tour as a boom of billion-dollar developments transform Manhattan’s skyline.

“Part of the reason for coming over here is to peer into the future and look at how these cities handle growth and how they transform big chunks of their city and mix private profit and public benefit,” Ken Morrison, chief executive of the Property Council of Australia told Domain in New York.

In May, the council published a paper written by renowned urbanist Greg Clark.

The paper found Australia’s five largest cities – Perth, Sydney, Melbourne, Brisbane and Adelaide – were failing by pursuing a low-density, low-amenity model with poor infrastructure, affordability and connectivity.

Mr Clark said if the current model – where people are forced to the city fringes for entry level affordable housing – was to be repeated for a decade more “it would be an unforgivable failure”.

His research noted: “We need to be able to persuade people that the quarter-acre block is not only way to enjoy suburban life.”

Mr Morrison said he found government and private business in New York working together to create affordable housing and encourage development – with a mature built-for- rent market – whereas the Australian government had more of an “oppositional” attitude toward large-scale developments and renewal.

In New York, billion-dollar projects are transforming old industrial areas and rail yards into new business and retail hubs and neighbourhoods.

One of these sites is Hudson Yards, currently the largest real estate development in America worth a staggering $20 billion [$27.5 billion].

Consisting of 16 skyscrapers built above rail yards on Manhattan’s west side, the new neighbourhood will include public parks, art installations, an exhibition centre, retail, restaurants with a mixture of affordable housing.

“Place-making is really taking something and creating something special there so people see it as a place,” Mr Morrison said.

“One of the most celebrated examples in Australia recently is Barangaroo; taking an empty wharf and making a really amazing place that is just buzzing at the moment.

“All these different mixes of things to create a place.

The Australian property industry focused on that but seeing it on another level in New York is incredible.”

Mr Morrison said the Australian dream was changing and more Australians would live in highly developed and high-amenity clusters.

“If we look to the future in Sydney or Melbourne or Perth, they can’t do the next 20 years like the last 20 years.

Read the full article here

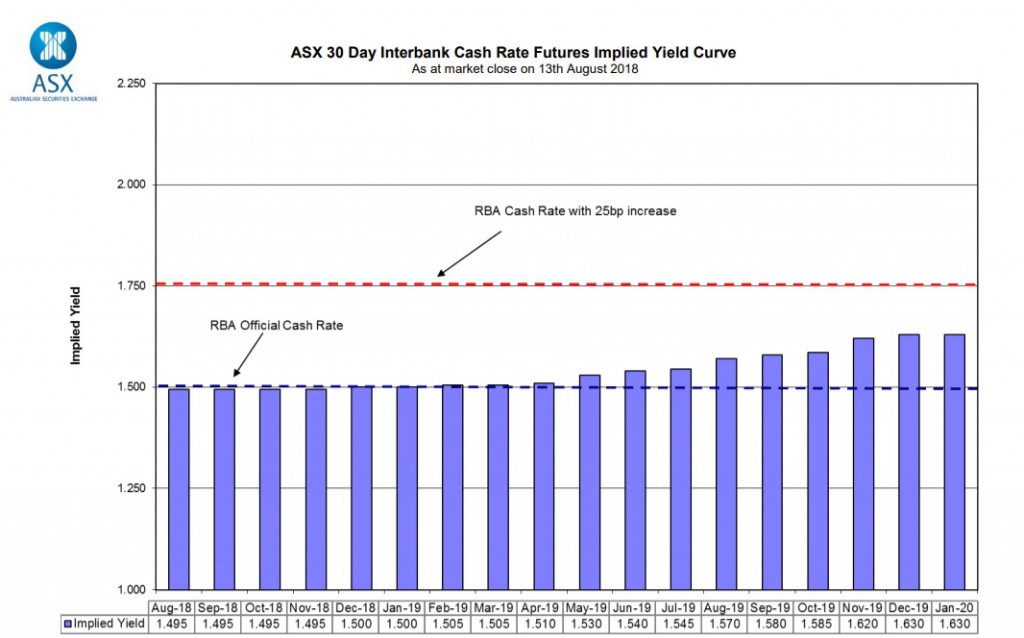

No rate hikes in 2018, 2019, 2020(?)…

Can we really expect a rate rise anytime soon?

This Blog by Pete Wargent looks at the statistics.

Yield curve flat

The Reserve Bank now sees headline inflation falling back to 1¾ per cent, as electricity and fuel prices fall.

Kudos to Westpac economics for calling this.

And the market is finally waking up to this reality.

No rate hikes are priced in, as far as the eye can see…

And a lot can change between now and 2020, of course.

Read the full article here

Melbourne’s market continued to lead Australian house prices lower last week

When it comes to prices falling, it would seem that Melbourne is winning the race.

An article on Business Insider takes an insider look at the results.

Australian house prices continued to edge lower last week, the latest data from CoreLogic shows.

Homes prices fell by 0.1% across Australia five largest capital cities — a repeat of the combined result from the previous week.

Last week’s price moves were led by sharper falls in the Melbourne market, which dipped by 0.3%.

It followed a 0.2% fall in the week prior, and annual price falls in Melbourne climbed above 1% for the first time in the current downturn.

Sydney’s market saw a repeat of the previous week’s 0.1% fall, with annual declines rising to 5.6%.

Offsetting those falls, Brisbane’s housing market reversed the previous week’s 0.1% fall with a gain of 0.2%.

Adelaide’s market held flat for the second straight week while Perth dipped by 0.1%.

The combined falls took place amid an improvement in auction clearance rates, particularly in the Sydney market.

Analysts at ANZ last week pointed to steady auction activity as a sign that Australia’s housing market may steady in the second half of the year.

For now, house prices in Australia’s major east coast markets are still struggling for traction.

The number of new listings — defined as properties listed within the last 6 months — increased to 6,275 in Sydney last week, up from 5,971 in the week prior.

New listing also rose in Melbourne, Brisbane and Adelaide.

Read the full article here

Why are luxury apartments booming in Brisbane?

The sun continues to shine on Brisbane’s property market – with luxury apartments experiencing a boom.

So what is causing the affect?

In this article for Switzer, John McGrath explains what’s going on.

Prestige apartments in Brisbane’s inner-city are hot property, with a growing number of local and interstate downsizers looking for large, well finished lifestyle apartments at prices that represent far greater value compared to Sydney and Melbourne.

The recent construction boom might have created a temporary oversupply in Brisbane, but the best of the best apartments are in high demand.

The value gap between the southern capitals and Brisbane remains significant and as a result we’ve experienced an influx of out-of-area downsizers.

One of the reasons for increased downsizer activity is that more buildings are nearing or at completion, which allows owner occupiers their preference to actually see properties before purchasing.

When they were in pre-sale stage, the bulk of buyers were a mix of local or foreign investors.

Downsizers are being driven by the volume of high quality new stock available and an increasing desire for low maintenance living.

Brisbane’s inner city has changed with many vibrant dining and entertainment precincts that come alive at night.

Middle aged buyers are increasingly wanting to ditch the maintenance of a house for a riverside apartment with eateries at their doorstep.

Fewer new projects are being launched in Brisbane this year and buyers are realising that absorption of excess stock is underway.

New market confidence

Drew Davies of McGrath New Farm says an uptick in high end apartment sales over the past year has instilled new assurance in the market.

He just sold a luxury one bedroom riverfront apartment for $2.625M.

This was an exceptional price and a good demonstration of how highly sought-after the highest quality properties are and the premium buyers are willing to pay to secure them now.

In fact, this property was snapped up before the marketing even commenced.

Drew said: “When comparing Brisbane’s inner-city market to Sydney and Melbourne, it’s a much cheaper price point and represents incredible value when you look at the growth and infrastructure upgrades happening throughout South-East Queensland.”

In my view, Brisbane is one of the world’s great cities and there is a lot more growth to come over the next few years.

Topping the charts

Just recently, Brisbane appeared for the first time on the internationally recognized Knight Frank Prime Global Cities Index, which measures the top 5% of a city’s housing market by value and is considered a means of gauging where luxury prices are headed at a time.

According to the Index, demand for high-end property in Brisbane led to 3.6% growth over the past year.

Researchers attributed Brisbane’s new ranking to the growing demand from downsizers.

The latest CoreLogic Hedonic Home Value Index also reveals a healthy prestige market in Brisbane, with 1.05% growth in the top quartile over the past 12 months.

Whereas Sydney (-8.0%) and Melbourne (-4.1%) both reported falls across the most expensive quarter of the market.

Read the full article here

‘It’s a wake-up call’: Melbourne loses top spot on liveability ranking to Vienna

Its the end of an era – after 7 glorious years, Melbourne loses it’s title of the ‘Most Liveable City in the Wold’ – but why?

This article form The Age explains why this is should be a wake-up call.

After seven years at the top of The Economist’s rankings as the world’s most liveable city, Melbourne has been displaced by Vienna.

Key to Vienna’s win is less of what the Economist Intelligence Unit called “petty crime”.

Melbourne ranked 12th internationally among cities for petty crime, while Vienna had the best ranking.

Although both cities registered improvements in their “liveability” – a ranking of 140 cities worldwide, across five broad categories of stability, healthcare, culture and environment, education, and infrastructure – increases in Vienna’s ratings were enough for the city to overtake Melbourne.

The two cities are now separated by 0.7 of a percentage point in the rankings, with Vienna scoring a near-ideal 99.1 out of 100 and Melbourne 98.4.

Two other Australian cities were in the top 10: Sydney (fifth) and Adelaide (10th).

Vienna regularly finishes at the top of other city ranking polls, including consulting firm Mercer’s quality of life survey.

Melbourne was 16th in that survey this year.

This is the first time Vienna has topped The Economist Intelligence Unit’s rankings since they started it in 2004.

Last of the 140 cities studied was Damascus, followed by Dhaka in Bangladesh and Lagos in Nigeria.

Some of the world’s most dangerous cities are not included in the poll.

As well as providing Melburnians with a sense of where they stand in the world, surveys such as this provide a guide for expatriate workers and the companies who uproot them from one country to another.

The magazine’s publisher says the report is done both to market The Economist and help multinational corporations assign staff “a hardship allowance as part of expatriate

relocation packages”.

An economist with Deloitte Access Economics, Daniel Terrill, has worked with Fairfax Media on liveablility studies for Sydney and Melbourne, and knows The Economist’s rankings system well.

He said the demotion of Melbourne to number two was only a small fall.

“But it is a wake up call that our liveability – and all the values that liveability encapsulates – can’t be taken for granted as we grow,” Dr Terrill said.

“We’re the fastest growing city in the country that, within a decade, will also become the biggest city in the country

He said most migration from elsewhere in Australia to Melbourne was because it was a good place to live.

“This brings great opportunity if we’re clever but, if we’re not, it threatens our liveability.”

Read the full article here

No comments:

Post a Comment