The Reserve Bank (RBA) released the minutes of their June 2016 board meeting earlier this week.

At the meeting the RBA chose to maintain official interest rates at their current setting of 1.75%.

In revealing their decision to keep official interest rates on hold the Board noted that:

‘Following the reduction in the cash rate in May, the Board judged that leaving the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and inflation returning to target over time.’

With regard to housing, the RBA noted that value growth has started to pick-up again in Sydney and Melbourne however, they anticipated that the magnitude of future value rises would be impacted by the considerable number of apartments due to come on stream over the next couple of years.

The Australian Bureau of Statistics (ABS) released their residential property price index results for March 2016 earlier this week.

The data showed that according to their measure, property prices fell by -0.2% over the quarter however, they had risen by 6.8% over the past year.

The ABS estimates there were 9.662 million dwellings nationally in March 2016 and the value of these dwellings was estimated at $5.9 trillion.

Importantly, the total number of dwellings has increased by 171,700 which accounts for 1.8% of the total dwelling stock.

Late last week the ABS released Labour Force data for May 2016. The data showed that the national unemployment rate was recorded at 5.7% for the third successive month.

Over the past year, the number of people employed has increased by 1.9% however part-time employment growth has been much stronger than growth in full-time employment at 0.8% and 4.4% respectively.

A record-high 31.6% of total employment is now part-time, up from 30.9% a year ago and 29.8% five years ago.

Encouragingly, with the increases in employment over the past year the number of people unemployed has fallen by -1.9%.

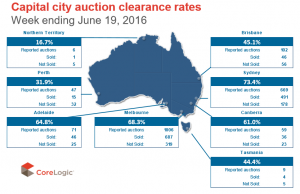

Over the week ending June 19 there were 2,183 capital city auctions with CoreLogic collecting results for 1,963 auctions, accounting for almost 90% of all auctions held.

The final clearance rate was recorded at 67.4% up from 65.7% over the previous week.

The number of auctions increased from 1,100 over the previous week when volumes were lower due to long weekends in most states.

Last week, across Melbourne, 1,085 auctions were held with a clearance rate of 68.3%.

Melbourne auction volumes increased from 341 the previous week.

Sydney’s auction clearance rate was recorded at 73.4% across 768 auctions with the clearance rate down from 74.1% across 463 auctions over the previous week.

Across all other regions except for Perth and Tasmania auction clearance rates were lower over the past week.

Note that sales listings are based on a rolling 28 day count of unique properties that have been advertised for sale.

Relative to the same period last year, the number of new listings over the past twenty eight days is -2.9% lower on a national basis and the total volume of stock on the market is 2.4% higher.

Across the combined capital cities, new listings are -3.0% lower relative to last year, while total listings are 10.9% higher.

On a city-by-city basis, Brisbane (+0.5%), Adelaide (+5.5%), Perth (+9.0%) and Canberra (+9.2%) are seeing a higher number of new listings than a year ago.

In terms of the total stock available for sale, Hobart (-29.9%) and Canberra (-11.5%) are the only capital cities to have fewer total properties for sale than a year ago.

New listings are at their lowest level in 4 weeks nationally and at their lowest level in 21 weeks across the combined capital cities.

Total listings are at their lowest level in 4 weeks nationally and at their lowest level in 8 weeks across the combined capital cities.

No comments:

Post a Comment