Sure the Sydney property boom is over, but its fundamentals are still strong and after a slight retraction at the beginning of the year, Sydney’s price growth has resumed at a much more sustainable level.

It’s true that Sydney property prices are high, but that doesn’t mean they’re going to crash, despite some predictions that Sydney’s property bubble will burst.

Remember – Sydney is an international coastal city, that deserves a premium price for it’s lifestyle as well as its amenities.

Yes… Sydney’s property market has moved from fifth gear into second gear, but it’s not into reverse, so there is no need to panic!

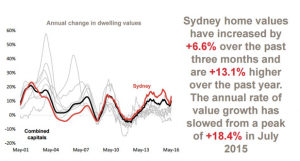

Source: Corelogic

What’s next?

It’s important to recognise what’s behind this move into the next phase of the property cycle, because a slowing market, especially in Sydney, doesn’t necessarily mean a significant price drop or correction – which is seems to be what many potential buyers who missed out over the past few years are secretly hoping for.

You see, the economic fundamentals of Sydney still stack up so the chances of a “bust” seem minimal at best and historically have actually never happened in any of our major capital cities.

The Sydney property market has performed strongly over the past three years, but this has been underpinned by strong jobs growth – with Sydney producing around half our jobs over the last year, strong population growth and also a relative undersupply of properties.

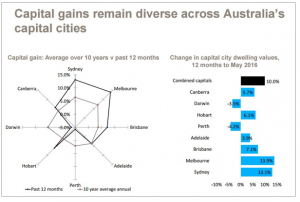

The latest property statistics from CoreLogic RP Data also confirm that Sydney is a long way from bust territory – in fact, property prices have firmed over the past three months.

Over the three months to May, Sydney posted a dwelling value increase of 6.6 per cent, based largely on strong monthly growth in May of 3.1 per cent.

After such a strong performance across the Sydney housing market, its annual rate of growth has moved substantially higher to reach 13.1 per cent per annum after reaching a recent low point of 7.4 per cent per annum growth over the 12 months ending March 2016.

Further underpinning its solid performance, Sydney auction clearance rates remain firm, sitting at around the mid-70 per cent mark.

With such data now available, property experts continue to disagree furiously about whether prices are in a bubble and about the best measure of housing affordability.

Treasury secretary John Fraser has said that Sydney house prices are in a “bubble”, but many economists remain wary of the term and point out that supply constraints and strong population growth will underpin prices, even if slower wages growth inhibits further price gains.

We must also remember that looking back over the past decade, Sydney house growth was unremarkable, which is perhaps why its recent growth has, conversely speaking, seemed so remarkable.

In my opinion, it was long overdue and had an element of catch-up to it after a long period of very flat conditions and the continued undersupply of new dwellings to match its strong population growth over the same period.

Rental Yields are low

Sydney’s rental market continues to mostly hold its ground – although yields are reducing due to its higher property prices.

The Real Estate Institute of New South Wales (REINSW) reported that residential vacancy rates in inner-ring Sydney fell by 0.6 per cent to just 1.3 per cent in February.

Vacancy rates in Sydney’s middle-ring also tightened to 1.6 per cent, however, vacancy rates in outer Sydney look to be a bit looser at 2.1 per cent – which is still considered an undersupplied rental market.

To some extent, this reflects what we have seen in auction clearance rates in 2016, with the inner-ring suburbs often recording exceptionally strong results, but sentiment waning in the outer and in the Hills District.

But beware of oversupply in some locations

While I believe that there is unlikely to be any significant fall in price in most parts of our most populous city, there are some concerns about the oversupply of properties that is looming in certain locations of Sydney.

The value of residential construction projects starting in Sydney this financial year is set to be more than triple the previous year’s, according to PRDnationwide analysis.

The top five suburbs by total value of projects starting construction in this financial year, according to PRDnationwide, are:

- Parramatta $1,014,202,000

- Kellyville $867,028,000

- Sydney (CBD) $771,336,000

- Ryde $539,349,000

- Botany $463,770,000

That’s why I’d be very, very careful and avoid buying:

- Off-the-plan properties

- New properties in the large developments

- Established properties close to those locations where an oversupply new projects is looming.

So what is a bubble?

A housing bubble doesn’t just mean high prices — prices can just be high in response to basic supply and demand.

A housing bubble is defined by rapid rise in property prices, where house prices are a long way away from what is fundamentally considered justified and generally occur when highly leveraged speculators enter a market for short-term growth.

And it is usually also associated with strong credit growth.

The problem is that property bubbles are often hard to detect in real time because there are so many different Australian property markets and there is so much disagreement over the concept of affordability and the fundamental value of properties.

The fact is, most market movements are influenced by those who keep the markets moving – humans and our psychological responses to perceived highs and lows.

This reality, combined with today’s 24/7 information superhighway, means markets are being influenced in different ways and with more frequency.

Real estate bubbles are caused by a rapid escalation in house prices, fuelled by a level of buyer demand that outweighs supply.

Something generally happens to spike buyer demand, as in the recent case of low interest rates making property relatively cheap to leverage into.

This upward movement entices “speculators” into the market, further fanning the capital growth flames with increased investment activity.

Then eventually some other influence comes along to quell demand, (often rising interest rates) even though the supply pipeline is still pumping out newly built dwellings.

This causes prices to slump and it is said that it could lead the real estate bubble to burst.

The problem I have with all the recent ‘housing bubble’ propaganda is that it’s largely one-dimensional, failing to account for the many underlying fundamentals that influence our unique property sector.

Is Sydney in Bubble territory?

The Sydney house prices recorded extraordinary price growth from 2013 to 2015, after moving up steadily since 2008, however by the end of last year that growth started to slow.

We also need to remember that the Sydney property market was mainly flat from 2003 – 2008 a decade before that recent short burst of strong growth.

Media reports say that Sydney houses now cost 12 times the annual income, up from four times about 40 years ago.

But thanks to record low interest rates, it still costs less today to service a mortgage out of the typical income than it did in 1989 when interest rates hit an eye-wateringly high of 17 per cent.

Respected economist Saul Eslake doesn’t expect a property price crash, but says that forces are shifting that will dampen demand and increase supply, and that slower population growth will limit new demand.

There are also a number of current, and proposed, policies that are taking some of the heat out of the market, particularly for investors.

In late 2014, the Australian Prudential and Regulatory Authority (APRA) believed that Australian banks were over-leveraging their residential loan portfolios, especially in the light of tighter world standards.

So the banks were told that they must not increase their investor lending by more than 6% (in some cases it was 10%) a year and were also required to raise a large amount of capital by issuing shares.

This has resulted in banks tightening their lending criteria including requiring larger deposits and stricter interest servicing criteria.

At the same time foreign property investment in Australian property has slowed a little in response to the slowdown in the Chinese economy, the higher Australian dollar and China restricting the outflow of funds from that country.

The Bottom Line

As I’ve been saying, I don’t believe that the Sydney property bubble will burst.

What we’re likely to see is a reduction in price growth, which was never sustainable anyway, and then a progression into more flat market conditions in a few years time– just as occurred the last time Sydney posted a short burst of strong property price increases.

No comments:

Post a Comment