New housing supplies been very much skewed towards apartments across the Brisbane region.

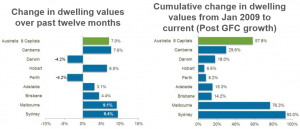

The third highest rate of capital gain over the cycle to date was in Brisbane at 18%.

The Brisbane housing market has struggled with value growth, the city continues to lag well behind.

The strong combined capital cities headline result masks the underlying movements associated with dwelling values which are trending differently from region-to-region and across the broad property types.

Demonstrating the decrease in housing affordability, utilising household income data for the June quarter provided by the Australian National University, the household income to dwelling price ratio was 8.4 in Sydney and 7.2 in Melbourne, compared to 5.7 in the Brisbane property market.

At a combined capital’s level, house values rose by 7.2% over the past twelve months, compared with a 5.5% rise in unit values.

The trend for house value growth outperforming unit values is apparent across most of the capital cities, particularly in Brisbane, where concerns around inner city unit oversupply are mounting.

House values by more than double the rate of units over the past year in each of Melbourne, Brisbane, Adelaide and Canberra.

No comments:

Post a Comment