There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

Six weeks to prevent a housing collapse

The Australian housing market has been put on a sand timer – set for roughly 6 weeks before a collapse.

An article on news.com.au reported that unless there are significant changes made, a collapse is looming and the countdown has well and truly started.

AUSTRALIA has roughly “six weeks” to prevent a housing market collapse caused by the banks’ crackdown on foreign investor lending, a US defence think tank has warned.

In an article titled “Australia Risks Strategic Setback From a Significant Foreign Direct Investment Drop Due to Changes in Bank Policies”, the Washington-based International Strategic Studies Association warns that Australia “may be entering a significant phase of its economic-strategic development”.

It argues “changes in local banking policies” could see foreign direct investment in the property sector “decline markedly”.

“This will profoundly impact the Australian government’s ability to fund major programs in the defence and civil sectors,” it said.

The article is contained in the ISSA’s latest Global Information System newsletter, described as a “strategic intelligence service for use only by governments”.

“The Royal Australian Navy’s submarine acquisition program, budgeted at $50 billion, may be the first major defence casualty,” the article said.

“However, the government itself seems unaware that the anticipatory caution on the part of Australian banks may accelerate a decline in the Australian economy.”

ISSA president, West Australian-born Gregory Copley AM, told news.com.au the “banks’ caution is precipitating the market collapse”.

“We estimate that Australia has about six weeks or so to turn this situation around, otherwise there would be a massive hit on property valuations and the building trades,” he said.

Click here for the full article

Get used to being outside your comfort zone + How agents use data about you

Another great Real Estate Talk show produced by Kevin Turner.

Michael Yardney recently told us why he likes 70’s units, in this interview he highlights the 6 mistakes investors must avoid if they are wanting to invest in older units.

Brad Beer talks about his personal philosophy on property investment.

Kylie Davis from Core Logic RP Data, explains how real estate agents use that and what do they really know about you.

Jo Chivers from Property Bloom talks about how she has developed her own portfolio and imparts that knowledge to her clients.

Nhan Nguyen from Advanced Property Strategies, answers a listeners question surrounding property investing.

If you don’t already subscribe to this excellent weekly internet based radio show do so now by clicking here.

How not to be unemployed in Australia

Anyone’s who has ever been a graduate from university and had their first interview will agree there’s one common dreaded question – “how much experience do you have?”

Unemployment among Austrian youth isn’t new, but it also isn’t changing.

This Blog by Pete Wargent, looks at the statistics behind youth unemployment.

Wasted youth

How best not to be unemployed in Australia?

Don’t be young cobber, basically.

The slightly more heartening news is that once you get over the age of 25 you’re relatively unlikely to be unemployed.

The historical figures by age cohort that I’ve charted below provide some context.

Unfortunately when the economy isn’t firing it seems to be more or less inevitable that young people with less experience are the first to be punted and the last to be re-hired.

But whichever way you spin the numbers an unemployment rate of above 12 per cent for 15-24 year olds in Australia is unacceptably high.

Read the full article here

Housing affordability improves over June quarter

One of the most common concerns of home buyers searching for a property is affordability.

In fact, most of us have been inundated with fearing headlines that affording a house has become so out of reach, the chances of finding a property is almost impossible.

Yet according this this article from Your Investment Property Magazine, things are looking up.

The latest REIA Housing Affordability Report showed that the proportion of median family income required to meet average loan repayments has dropped to 29.4% over the June quarter – the best level since June 2009.

“Most states and territories saw improvements in housing affordability,” said Neville Sanders, president of the Real Estate Institute of Australia.

He noted that this could have been the result of favourable interest rates and modest income rises.

Victoria recorded the greatest improvement among all the states, with the proportion of income needed to meet average monthly loan repayments dropping by 1.7% to 31%.

Only the Australian Capital Territory saw a decline this quarter, while both New South Wales and Queensland recorded no change.

Rental affordability also improved, with the proportion of median family income required to meet median rents dropping from 25.1% to 24.8%.

The Northern Territory, South Australia, and Tasmania saw the most improvement across the country.

Read the full article here

Women Find This Much Facial Hair Most Attractive

There’s been an age old question puzzling men worldwide: What do women really want?

Evidently the answer is much simpler than anyone thought – facial hair.

An article on PsyBlog has revealed that according to research, women find with facial more far more compatible as long term partners.

Women judge fully bearded men to be a better bet for long-term relationships, new research finds.

This might be because it makes men look more ‘formidable’.

Certainly, beards make men look older and more aggressive.

Beards are also often judged to make men look like they have higher social status.

However, for short-term relationships, women judge stubble to be most attractive, the new research found.

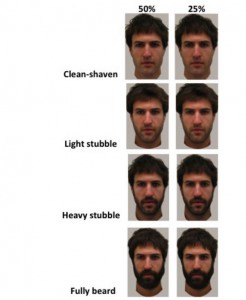

The study showed pictures of men with different levels of facial hair to over 8,000 women.

Men’s faces were also ‘masculinised’ and ‘feminised’ by computer manipulation to see what effect this would have.

Here is an example of the feminised male faces along with different beard growths.

Click here for the full article

No comments:

Post a Comment