There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

Mortgage insurance pushes borrowers towards bankruptcy

There’s an old saying – no matter what you sign, ‘always read the fine print’.

This theory could not apply more to borrowers signing mortgage insurances.

Reported in this article on Your Investment property Magazine, borrowers are too often unaware of the policy they are signing – leaving them in financial strife.

As Australia’s mortgage insurance providers force struggling homeowners into bankruptcy, a bank analyst has revealed that most Australians don’t understand that their policies favour lenders, not borrowers.

Over the past decade, QBE LMI and Genworth Financial – Australia’s two main mortgage insurance providers – have launched bankruptcy proceedings against dozens of homebuyers

to recover debts from mortgage defaults.

According to figures from the Australian Prudential Regulation Authority (APRA), borrowers spent almost $500m on about 100,000 lenders mortgage insurance (LMI) in the first half of the year.

LMI is compulsory for all borrowers who do not have a 20% deposit.

However, borrowers have a different understanding on what a mortgage insurance policy does.

“Around 70% of households believe that lenders mortgage insurance protects them rather than the lender,” banking analyst Martin North told ABC.

“So it’s not totally clear to them that this is something that protects the bank rather than the borrower and I personally think that there needs to be better disclosure with regard to this particular product set.”

Click here for the full article

“No sign of a crash” – Dr Shane Oliver + Purple Bricks turns the industry red with rage

Another great Real Estate Talk show produced by Kevin Turner.

Michael Yardney gives us some of the time tested rules these successful investors use to make their fortunes.

Dr Shane Oliver head of Investment Strategy and Economics, and Chief Economist at AMP Capital joins us to answer questions around how the Australian economy is tracking.

Michael Bruce CEO of Purple Bricks, discusses the Australian launch.

Miriam Sandkuhler from Property Mavens, takes us through his property journey.

David Wooldridge CEO and Co-Founder of The Tiny Homes Foundation, discusses the newly approved home project for disadvantaged and the homeless in NSW.

If you don’t already subscribe to this excellent weekly internet based radio show do so now by clicking here.

Sting in the tail

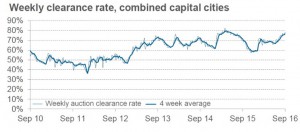

As the year slowly approaches it’s end, it’s a good time to reflect on the this year’s auction clearance rates so far.

This Blog by Pete Wargent, looks at the results and compares them to last year’s results.

Year-end approaches

Auction clearances limped over the line at the end last year as the regulator intervened in the smoking hot markets.

That was particularly so in Sydney, where by the end of 2015 the odds of making a sale at auction were no better than a game of Two-up, without even the beer for compensation.

However, a couple of mid-year interest rate cuts have helped to breathe life back into the market of late.

Super Saturdays

Sydney’s clearance rate was well up from 71.7 per cent the corresponding weekend last year to a dizzying 84.4 per cent, albeit on lower volumes, according to CoreLogic.

Even with the help of Super Saturday, the Eastern Suburbs has remained particularly short of stock, and prices are flying.

The lack of willing sellers in the east is something of a conundrum – either the four year boom has exhausted the supply of vendors, or excessively high stamp duty is resulting in ‘asset lock-in’.

Or maybe after all this time people have just forgotten that prices move in two directions.

Melbourne’s clearance rate of 79.1 per cent was also well up from the same weekend last year, when the clearance rate was 72.7 per cent.

Read the full article here

First home buyers fear they will struggle to afford repayments despite record low rates

Can first home buyers really afford a property?

That’s is the questions that has sparked debates nation wide – and not there’s a new theory in the mix.

According to an article on news.com.au it’s no longer just about the deposit or loan approval – but the ability to maintain repayment has made affordability even further out of reach.

IT LOOKS like the worries faced by first home buyers don’t end after they scrimp and save to get their deposit together.

A new survey by Mortgage Choice found paying back their loan was a major source of worry with almost a third saying their biggest concern about owning a home was not being able to afford their repayments.

This is despite record low interest rates.

In August, the Reserve Bank of Australia cut the official interest rate to 1.50 per cent — the lowest it has ever been.

The cash rate has been cut 12 times by the central bank since it began its monetary policy easing cycle back in November 2011, when it reduced the cash rate by 0.25 per cent to 4.50 per cent.

Mortgage Choice chief executive John Flavell said it was “disconcerting” to hear so many first home buyers worry about how they will manage their debt.

“The reality is, interest rates have never been lower, meaning it should be easier than ever for borrowers to manage their debt,” he said.

“Most first home buyers would have an incredibly competitive rate — a rate they are unlikely to retain for the duration of their loan.

If first home buyers are worried about meeting and managing their mortgage repayments now, how are they going to feel when interest rates start to rise?”

Read the full article here

10 Jobs That Make People Most Happy

We all have a dream job in mind – that one role that we believe will make us both financially and emotionally content.

But is your dream job part of the the top 10 that makes people the most happy?

A study published in an article on PsyBlog has revealed a list the the top 10 occupation making people most happy and the 10 making them most miserable.

New research published by The Cabinet Office in the UK has revealed that being a member of the clergy is associated with the highest levels of life satisfaction.

Here are the top 10 occupations:

- Clergy

- Chief executives and senior officials

- Managers and proprietors in agriculture and horticulture

- Company secretaries

- Quality assurance and regulatory professionals

- Health care practice managers

- Medical practitioners

- Farmers

- Hotel and accommodation managers and proprietors

- Skilled metal, electrical and electronic trades supervisors

The research is part of the drive by the UK government to provide information which might give a boost to the nation’s well-being (ONS, 2014).

In descending order of life satisfaction, then, here are the 10 occupations in which people are least satisfied.

- Plastics process operatives

- Bar staff

- Care escorts

- Sports and leisure assistants

- Telephone salespersons

- Floorers and wall tilers

- Industrial cleaning process occupations

- Debt, rent and other cash collectors

- Elementary construction occupations

- Publicans and managers of licensed premises

Click here for the full article

to recover debts from mortgage defaults.

to recover debts from mortgage defaults.

No comments:

Post a Comment