Is it a myth, fact or coincidence that property doubles over ten years?

CoreLogic Property Pulse takes a deeper dive into property performance over the decade, and with some interesting results.

Looking at median selling prices over the past decade, the national median house price ten years ago was recorded at $330,000, while the median unit price was $310,000.

Ten years on, and the median selling prices are now $499,000 and $445,000 respectively.

What we’re seeing here is a selling price increase of 51% for houses over the decade and by 44% for units.

Clearly, based on broad averages, in most areas of the country median prices have not doubled over the past decade.

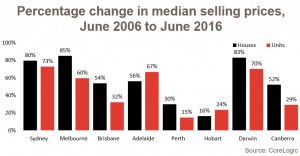

Across individual capital cities the results diverge significantly, however none of the capital cities have seen the city-wide median house or unit prices double over the past decade.

Prices have gone closest to doubling over the decade in Sydney, Melbourne and Darwin while in Perth and Hobart the total change for houses and units has been well below 50%.

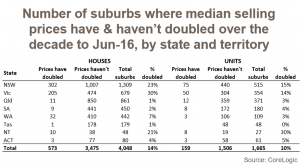

Of the 4,048 suburbs nationally for houses, only 573 suburbs or 14% have seen the median selling price of a house double over the past decade.

For units, only 159 of the 1,665 suburbs nationally, or 10%, have seen median prices of units double over the past decade.

A split of suburbs (refer adjacent chart) that have, and have not, seen median selling prices double over the past decade across each state and territory includes:

- Houses: NSW, Vic and NT are the only states and territories in which more than 10% of suburbs have seen prices double over the past 10 years.;

- Units: again only NSW, Vic and NT saw more than 10% of suburbs recording prices as doubling;

- Not one suburb in Tasmania has seen a doubling in median price over the past decade.

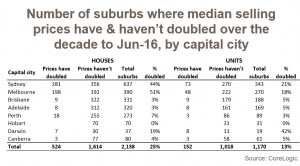

An overview (refer adjacent chart) of the capital growth performance for capital city suburbs over the past decade shows:

- For houses: Melbourne is the only city where half of the individual suburbs saw median selling prices double over the past decade while Sydney has also seen more than 40% of suburbs doubling in price. Darwin is the only other capital city where more than 10% of suburbs have seen selling prices of houses at least double over the past 10 years.

- For units: once again Sydney, Melbourne and Darwin are the only capital cities in which selling prices have more than doubled in at least 10% of suburbs.

A comparison of the two adjacent tables highlights just how much stronger price growth has been in the capital cities than across regional markets.

It also highlights just how much the strong growth over the decade has been tilted towards Sydney, Melbourne and Darwin.

Of course, values are already declining in Darwin while they continue to rise in Sydney and Melbourne.

The next time you hear of property prices doubling every seven to ten years, although it can happen in certain areas, there are no guarantees.

CoreLogic analysis highlights the importance of buying strategically; on average most properties have fallen well short of doubling their value over a decade.

Using today’s data as an example, it highlights that far fewer owners have seen their real estate asset double in price over the past decade than those who have.

For those who have seen their property price double over the decade, they are most likely to be situated in Sydney, Melbourne or Darwin while in other capital cities and regional areas of the country the prospects of prices having doubled over this period are much lower.

No comments:

Post a Comment