CoreLogic-TEG Rewards latest consumer housing market sentiment survey results announced.

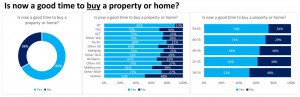

The latest housing sentiment survey by CoreLogic & TEG Rewards concluded that almost 70% of Australians think now is a good time to be buying a dwelling, despite dwelling values moving out of reach for many as the housing market broadly approaches four and half years of growth.

Comprising of 2,442 respondents, the survey showed that in Sydney, where affordability constraints are the most pressing of any capital city, a majority of respondents were pessimistic about whether now is a good time to buy a property, however slightly more than half the respondents still felt it was a good time to buy a property.

Conversely, in the regions where dwelling values have peaked and entered a downturn are where respondents are most confident about buying conditions; at least 80% of respondents in the Northern Territory and Perth indicated they thought it was a good time to buy.

Perceptions around selling a home have weakened over the past twelve months which is likely attributable to slower housing market conditions across many markets.

CoreLogic data shows that transaction numbers have been moderating across most capital cities however auction clearance rates are close to record highs and newly advertised listing numbers are tracking lower than a year ago nationally.

Unsurprisingly, the survey revealed that Sydney and Melbourne residents were more optimistic about selling conditions with almost three quarters of respondents indicating they thought it was a good time to sell in Sydney, while 70% of Melbourne respondents thought it was a good time to sell.

Based on CoreLogic data, Sydney and Melbourne continue to see auction clearance rates track around the 80% mark while private treaty sales are generally selling with minimal discounting.

The weaker performing housing markets are also showing the most pessimistic survey responses around whether now is a good time to sell.

Only 20% of respondents in Perth and the Northern Territory thought it was a good time to sell, highlighting the weaker housing market conditions and high stock levels that have been evident in these areas since 2014.

Perhaps somewhat counterintuitively, 67% of respondents indicated that they thought the Australian housing market was vulnerable to a significant correction in dwelling values.

The divergent results highlight the importance many Australian’s place on home ownership and /or the investment potential of housing.

A large proportion of respondents who were concerned about a significant fall in dwelling values were based in areas where home values have already moved lower; 90% of respondents from the Northern Territory thought that the market was vulnerable to a significant correction, while more than 70% of regional SA, regional Vic and Perth based respondents were also concerned about the possibility of a significant correction.

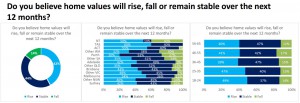

The CoreLogic-TEG Rewards housing market sentiment survey also explored views on which direction dwelling values and rental rates were likely to head over the next twelve months.

The majority of survey respondents are expecting dwelling values to remain steady over the next twelve months, with Tasmanians the most optimistic about the direction of value growth over the next twelve months.

No comments:

Post a Comment