Brisbane’s housing market has shown a larger capital gain spread, with house values up 4.7% compared with a 1.4% fall in unit values over the year.

The divergence in performance between houses and units is most clearly evident in Melbourne and Brisbane.

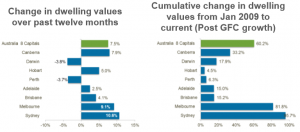

The Brisbane housing market recorded an 0.8 percent rise in dwelling values in October taking the annual pace of capital gains to 4.1 percent that’s well below the combined capitals average.

The weaker performance of unit values across the Brisbane market may be partially attributed to supply concerns.

As unit supply levels across key regions of Brisbane’s inner city show the potential for a significantly larger relative increase in existing stock levels when compared with Melbourne and Sydney.

The CoreLogic Settlement Risk report is currently tracking approximately 49,000 units that have been approved for construction across the broad Brisbane metro region.

While it’s unlikely that all projects will proceed through to commencement, based on the approval numbers across Brisbane, we could see an uplift in existing unit stock which is in excess of 25% over the next two years.

No comments:

Post a Comment