Investors storm back

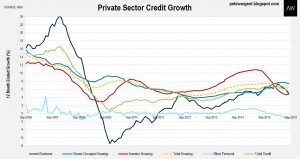

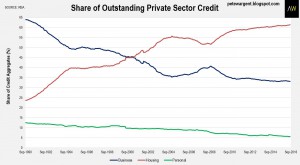

There have been a few indicators of property investors returning to the market over the past seven months, and the latest Financial Aggregates figures from the Reserve Bank of Australia (RBA) confirmed as much, with investor credit growth recording by far the strongest monthly result since last year.

Annual investor credit growth now looks set to rise strongly again, although the present level of +4.8 per cent remains well below the arbitrary 10 per cent advisory speed limit.

Owner-occupier housing credit rose by +7.3 per cent from a year ago, easing back from a six-year high.

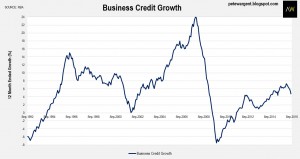

The weakness in business credit – and negative personal credit growth – put a dampener on total credit growth, which declined to +5.4 per cent from +6.6 per cent a year ago.

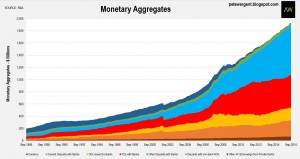

The tweak to higher term deposit rates has had the desired effect, with an +8.9 per cent year-on-year surge in TDs, being close to a four-year high.

Business credit growth, as noted, was yuck!

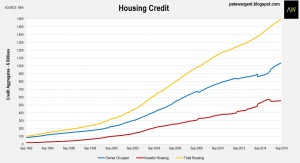

Housing credit continues to rise strongly, up by +6.4 per cent over the year to September towards $1.6 trillion.

It’s impossible to say for certain whether housing equity redraw could account for non-existent personal credit growth, or even some of the the weakness in business credit growth.

Who knows, really?

Regardless, apparently very solid total housing credit growth is now chasing lower new stock listings in Sydney and Melbourne.

Finally, housing now accounts for 61.3 per cent of outstanding credit, another record.

The wrap

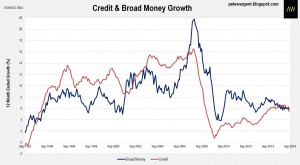

Overall, total credit growth seems to be softening.

The most noteworthy point by far was the strong monthly result for investor credit, a point which will not be lost on the regulators

No comments:

Post a Comment