How have your investment properties performed over the last few years?

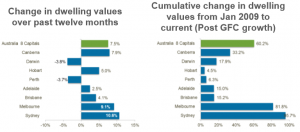

If you invested in the right properties in Melbourne, Sydney or Brisbane it’s likely that you’d be happy with their performance.

However, as a property investment strategist I regularly see investors who’ve bought properties in mining towns who are now “stuck” with no equity, or worse still, negative equity – in other words they owe more to the banks than their properties are worth.

And now they come to us at Metropole looking for investment advice to try and solve their problems.

Sometimes we can help them, but unfortunately sometimes we can’t because they’ve “invested” in mining towns.

We’ve always warned of the risks of investing into mining towns which:

- comprise of transient populations that are almost solely reliant on resource project employment and therefore experience large swings in demand.

- are driven by investors buying properties rather than owner occupiers

And many of Australia’s worst property markets over the last few years have mirrored the ups and downs of the mining sector.

These included places like:

Moranbah, Qld

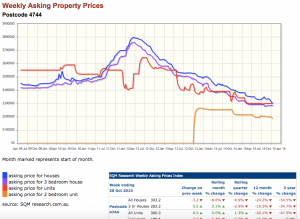

Now this was a popular “hot spot” a number of years ago as Moranbah’s median house price grew by roughly 30 per cent each of the 10 years to 2012 to reach $750,000, while rents rose to an average of $1800 per week.

Then the mining companies began operating fly-in, fly-out workforces in temporary workers’ camps and the property market went into free fall.

The median house price is now $215,000, and houses typically take eight months to sell (if at all) and rents have fallen to $300 per week.

Gladstone, Qld

Once the darling of the hot spotting websites investors flocked to Gladstone on the back of the three LNG facilities being built there.

The Gladstone house price boom started winding down in 2012 as workers began seeking jobs elsewhere at a time when an oversupply of properties hit the market fuelled by developers who constructed a mass of dwellings bought by investors hoping to make a killing .

Today many of the local workers (and there are fewer of them) have been accommodated in camps, leaving investors with vacant properties that have plummeted in value – some worth 30% less than they were 3 years ago.

Surat Basin, Qld

The Surat Basin was touted as one of the mining boom’s great “hot spots” because it is home to a major coal seam gas field.

Towns such as Chinchilla and Roma once boomed — until, like many of the other mining towns, oversupply from developers and investors killed their markets.

Western Australian Mining Towns

1. Newman, WA

House prices in the Pilbara town of Newman are lower than they were five years ago and fell 22 per cent in the past 12 months.

While a massive iron ore mine was recently constructed near the town, just like the other towns I mentioned above, the mining company bypassed investors and the local housing market by building a 2,000 room village to accommodate its workers.

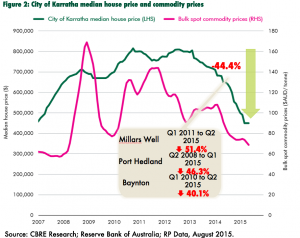

2. Port Hedland, WA

The end of the resources boom has also blown a hole in Port Hedland property market.

Port Hedland had a median house price of $1.3 million at its peak a few years ago. Today it is $850,000. The median weekly rent has dropped from $2500 to $1000.

These are just a few examples

Unfortunately many who invested in these and many other mining towns have negative equity and very few options.

If they were to sell their properties, in fact more correctly said, if they were able to sell their properties, they would not realise enough to pay off their mortgages.

At the same time, rents have fallen so that what was once a positively geared property has become a negatively geared property and, to make things worse, banks are frequently requiring principal and interest payments creating even more negative cash flow.

So what can we learn from this?

- We only recommend investing in our 4 big capital cities where there are multiple drivers of the economy with lead to jobs growth in many industries and wages growth.

- We avoid investing in regional or mining towns because they lack multiple growth drivers and they’re dominated by investors rather than owner occupiers who bring stability to the markets

Of course we don’t invest just anywhere in these capital cities or in any properties.

If you want to know more about where to invest and where not to invest in the challenging times ahead why not use the team at Metropole to help you find your next home or investm

Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

Please click here to organise a time for a chat. Or call us on 1300 20 30 30.

When you attend our offices you will receive a free copy of my latest 2 x DVD program Building Wealth through Property Investment in the new Economyvalued at $49.

If you’re looking for independent advice, no one can help you quite like the independent property investment strategists at Metropole.

Remember the multi award winning team of property investment strategists at Metropole have no properties to sell, so their advice is unbiased.

Just click on this link to find out more and organise an obligation free chat with one of our property strategists.

No comments:

Post a Comment