‘Why can’t I just do it myself or ask my Accountant to claim the depreciation deductions for me?’

This is a question often asked by investors when they call to discuss the potential deductions available due to the wear and tear of the building structure and the plant and equipment assets found within their investment property.

What many of these investors don’t realise is that it takes a very particular set of skills to calculate depreciation deductions correctly.

The Australian Taxation Office (ATO) recognise this and within Tax Ruling 97/25 they list Quantity Surveyors as one of a select group of professionals with the appropriate knowledge required to estimate construction costs for depreciation purposes.

When it comes to understanding the methods which can be used to maximise depreciation, no professional knows the legislation better than a Quantity Surveyor who specialises in property depreciation.

To demonstrate the difference a specialist Quantity Surveyor can make to the deductions a property investor can claim, let’s look at some methods used to maximise depreciation.

An immediate write-off can be applied to any plant and equipment asset within an income producing property which cost $300 or less within the first year of ownership, regardless of how many days the property is owned in that year.

Instead of claiming depreciation at the effective life the ATO set for each individual asset, this method can be used to allow the owner to claim the value of the total asset within the first financial year.

The table below shows how the immediate write-off rule can be applied to items beneath the $300 threshold to maximise deductions instead of using the diminishing value method rate.

As the table shows, without applying an immediate write-off, the investor is only able to claim a maximum of $354 for these assets using the diminishing value method.

By applying an immediate write-off the investor will receive $845 more in deductions for these assets in the first year.

This is only a sample of some of the assets which can be found in a residential property which may be valued at $300 or less and can fall into this category.

It is often these smaller items which get missed, so enlisting a specialist Quantity Surveyor to visit the property, perform a site inspection and list all assets found within a depreciation schedule will make a significant difference to an owners claim.

Low-value pooling is a method of depreciating plant and equipment assets at a higher rate to maximise deductions.

Two categories of assets can be allocated into a low-value pool to increase an investment property owner’s deductions:

• Low-cost assets – depreciable assets which have an opening value of $1,000 or less in the year of their acquisition

• Low-value assets – depreciable assets that have a written down value less than $1,000. That is, the value of the asset was greater than $1,000 in the year of acquisition. However, the remaining value after a previous year’s depreciation is less than $1,000. An example is a hot water system valued at $1,100. In the second financial year after installation, the asset would have depreciated to a written down value less than $1,000; meaning the item would then be eligible to be placed into a low-value pool.

By placing items in a low-value pool, property investors can claim depreciation for these items at a rate of 18.75 per cent in the year of purchase.

This is regardless of how long the property has been owned and rented.

From the second year onwards, the remaining balance of the item can be depreciated at an even higher rate of 37.5 per cent.

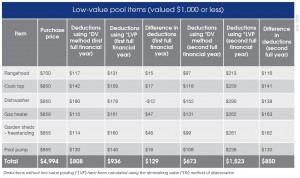

The following table demonstrates how placing eligible assets within a low-value pool will improve an investor’s deductions when compared to those found using the diminishing value method.

As the table shows, in most cases low-value pooling will increase the rate that an item will depreciate when compared with the deductions found using the diminishing value method.

The exception in this example is the dishwasher.

When using the diminishing value method a dishwasher can be depreciated at a rate of 20 per cent.

So, the deductions which can be claimed when the item is placed in a low-value pool in the first year of ownership are lower than those using the diminishing value method.

However, overall the investor will receive an additional $129 in deductions in the first year for these assets when low-value pooling is used.

In the second year, the remaining depreciable value of the dishwasher can also be depreciated at the increased low-value pool rate of 37.5%.

In the second year, the investor can claim an additional $850 when the low-value pooling is applied to these assets compared with what they can claim using the diminishing value method.

Investors can choose whether or not they wish to add items to a low-value pool.

However, they must be aware that once they decide to do so, these items must continue to be claimed using the low-value pool rates.

The same rule applies in reverse.

If they choose not to add assets to a low-value pool they must claim deductions using either the diminishing value or prime cost method.

If the investor purchases any additional assets in the future, the same method that the investor has chosen must also be applied to new assets.

Confusion can also arise with assets which form part of a group with a total cost exceeding $1,000.

For example, if a house has a set of six blinds which cost around $3,000 it would seem that the set doesn’t qualify for the extra depreciation available in a low-value pool.

However, these blinds can be depreciated at a faster rate as they qualify for the low-value pool as individual items.

These rules become more complicated when a property has more than one owner.

A specialist Quantity Surveyor can prepare a split depreciation schedule in a shared ownership scenario which allows each owner to claim the deductions for their portion of interest in each asset.

This can mean more assets will qualify to be written off immediately or added to a low-value pool, further maximising the deductions which can be claimed.

Enlisting the advice of a specialist Quantity Surveyor will not only improve deductions but also help investors to boost their cash flow.

The cost of a depreciation schedule is also tax deductible.

So, the better question an investor can ask themselves is ‘why wouldn’t I seek advice from a professional whose expertise is depreciation?’

No comments:

Post a Comment