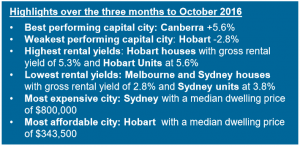

The Sydney market finished the month as the most expensive capital city with a median dwelling price $800,000.

The Sydney property market continued as the stand out based on annual capital gains, recording the largest year-on-year increase; dwelling values are now 10.6% higher over the past 12 months.

Detached houses (+10.9%) are showing only a slightly higher rate of capital gain compared with units (+9.1%) across Sydney, highlighting the healthier supply/demand dynamic that exists across the Sydney region for higher density housing.

This also points to higher demand for Sydney units considering how expensive Sydney houses have become.

Comparatively, in Sydney and Melbourne, the approved unit pipeline is higher at approximately 96,000 over the next 24 months, however the potential stock uplift is much less significant, at 13% and 16% respectively relative to existing unit stock levels.

Auction clearance rates, which are one of the most timely measures of the fit between buyer and seller expectations, have been tracking in the mid to high 70% range across the combined capital city markets, with the largest auction markets of Sydney general showing a higher rate of clearance.

In fact, over the past two months, clearance rates across Sydney have dipped below 80% only once.

A year ago auction clearance rates were consistently trending around the mid 60% range, albeit on volumes that were about 20% higher.

While dwelling values have broadly risen during October, rental yields in Sydney remain depressed, with gross yields are at record lows.

The typical Sydney house is now providing a gross rental return of just 2.8%.

Taking into consideration holdings costs, expenses and vacancy, the net rental yield for houses is likely to be closer to 2% in these markets.

With ongoing strong value growth and high clearance rates in Sydney, as well debate around affordability gathering some momentum, there is likely to be further caution by the Reserve Bank around future interest rate cuts, which, if it were to occur, may provide additional stimulus for housing markets around Australia.

No comments:

Post a Comment