Australians have always looked to the USA for economic indicators, if the US sneezes we catch the cold was the catch phrase…

The Global Financial Crisis in 2008 started in the USA and quickly sent world markets into a downward spiral, but what would happen if the World’s 2nd Biggest Economy China ‘sneezed’?

Over the last decade the Chinese economy has exploded, with extraordinary growth rates above 10%.

Although more recently this has tapered back to between 6-7%.

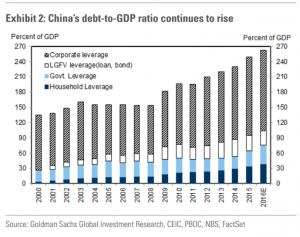

But now, there is real concern both inside and outside of China for the rising debt levels as it reaches record highs.

The International Monetary Fund (IMF) has warned China to stem the unsustainable growth of indebtedness across its state-owned firms in its latest check-up of the country’s economy.

While the fund said the debt level is still manageable, corporate debt now sits at 145% of GDP and is growing twice as fast.

“The deviation of credit growth from its trend, a key cross-country indicator of a potential crisis, has reached 20-25% of GDP – very high by international comparison,” the fund stated in its report.

The fund stressed that China needs to loosen its unsustainably high growth targets and tighten up its budget constraints, especially on State Owned Enterprises (SOEs) and local authorities.

It said reducing the access to credit of weak firms is not only critical for addressing the existing debt overhang, but also to improving the efficiency of new credit allocation.

Firms servicing viable debts should be restructured, while those that are not viable should be liquidated, it continued.

“Continued support of fundamentally non-viable firms will only result in greater losses.”

Highly indebted ‘zombie’ companies in particular should be targeted, it said, starting with those in “dynamic regions” whose workers would be able to find new jobs relatively easily.

Speaking to various contacts over the last few months who have dealings inside China they tell me concerns are high within the Chinese business community:

“China is buying up the world making hay whilst the sun shines ” says one prominent contact”; and they tell me they are fast-tracking safe investments before in their words the whole thing implodes”.

If China’s economy does implode that will send shock waves though the world’s economies, and off course the property sector will not be spared.

Furthermore, on the back of concerns of a housing market bubble spurred by cashed up foreign investors snapping up properties, and following on from the Australian Government’s tinkering to foreign investment rules, recent statistics show that some Chinese investors are not settling on off the plan purchasers due to a number of factors including local instability and nervousness.

This coupled with a potential correction to the world’s second largest economy would potentially spell disaster for Australia.

But all is not doom and gloom

Chinese authorities recognise these risks and have often expressed concern about the build-up in leverage. and have proposed a wide sweep of financial reforms and other actions needed to address the growing vulnerabilities.

This is just an opinion piece so there is no need to panic but we must learn from history.

We know that everything has a Life cycle: The property cycle, Share market cycle, Economic cycle.

As is the case in Nature, when there is an imbalance in the ecosystem, there is always a correction to bring things back to equilibrium.

It has been 8 years since the GFC, and longer still for China’s unprecedented growth rate and rising debt levels.

Which begs the question, what is China’s Life Cycle – when is it due for a correction?

No comments:

Post a Comment