Depreciation schedules should be arranged before and after any renovation

All too often we see investors contacting specialist Quantity Surveyors to organise a depreciation schedule after they have completed renovations to an investment property.

In most instances this is too late for the investor to claim all of the deductions they are entitled to.

If a client mentions they are considering renovating their investment property, it is important to recommend they speak to their specialist Quantity Surveyor straight away.

This is because there may be depreciation deductions available for any disposed assets or demolished building assets being removed during the renovation process.

Property investors scrap items within a property for several reasons.

The most common reason is ‘not fit for purpose’ because of obsolescence, functional inadequacy or dated style.

Essentially, if an item is scrapped it is a loss to the owner.

Legislation allows property investors to claim additional deductions over and above their normal depreciation claim for assets being removed from their property.

The remaining depreciable value of any scrapped items can be claimed in the year these items are removed from the property.

To take advantage of deductions for scrapped assets, a depreciation schedule must be arranged both before and after the renovation takes place.

This will allow the Quantity Surveyor to complete a site inspection of the property to value all of the items and to take photographic records of the assets contained within the property.

This evidence and the pre-renovation schedule will substantiate an investor’s claims should the Australian Taxation Office complete an audit of their annual income tax assessment.

Once the renovation has been undertaken, the Quantity Surveyor will compile an itemised schedule which will detail the depreciation deductions available for the new plant and equipment and capital works deductions obtainable for the owner of property.

Any removed assets identified initially will show a left over un-deducted amount in the property depreciation schedule.

This amount can be claimed immediately.

The new assets can then be depreciated as normal based on their effective life.

Depreciation and renovation case study

Jonathan purchased a fifty year old, two bedroom house. After renting it out for two years he decided to renovate the property.

In its pre-renovation condition the house contained carpet, blinds, an oven, a cook top, ceiling fans, a split system air conditioning unit, a hot water system and light shades.

Jonathan engaged a specialist Quantity Surveyor to complete a property depreciation schedule when he originally purchased the property two years ago.

Upon hearing about the additional deductions available when renovating from his Accountant, Jonathan contacted a Quantity Surveyor before starting the renovation to find out more.

After obtaining information and discussing the benefits, Jonathan found that he was able to use his existing schedule to work out the un-deducted value of the items which were to be removed during the renovation.

When the original property depreciation schedule was completed, a depreciation expert visited Jonathan’s house and conducted a full site inspection.

During this inspection they took notes and photographs of all depreciable items.

This original schedule included all of the items being removed from the property.

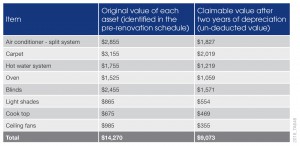

The table below outlines the extra deductions that became available to Jonathan during the renovation.

Jonathan claimed $9,073 in extra deductions that year in his personal tax return.

After Jonathan completed the renovation he contacted the specialist Quantity Surveyor to update the property depreciation schedule.

They inspected Jonathan’s property again, documenting all of the new additions.

The specialist Quantity Surveyor calculated the construction write-off allowance now available on Jonathan’s new extension.

Some of the new additions included a new oven, carpet, air-conditioning, a hot water system and blinds.

In addition to the $9,073 claimed on the removed assets, Jonathan was able to claim $8,700 in depreciation deductions on the new items in the first year alone and $29,300 in the first five years.

Jonathan was able to maximise the depreciation deductions on his investment property both prior to and after the renovation by taking the depreciation schedules to his Accountant to make his claim when he completed his annual income tax assessment.

No comments:

Post a Comment