There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

Is The Block the world’s worst development?

It may be one of the most popular shows on TV – but is the The Block really a good development?

An article on washingtonbrown.com.au has has broken down the numbers behind the glamour to see if it all adds up.

Washington Brown has crunched the numbers on The Block’s latest development in Melbourne’s inner-city bayside suburb of Port Melbourne, and something just doesn’t add up.

From a financial point of view the development, which consisted of transforming a 1920s art deco building into a luxury apartment block, was one of the worst he has ever seen.

While I understand the magic of television, Channel 9 has outdone David Copperfield in creating the illusion of a profit to the public!

Let’s look at the numbers:

According to reports Channel 9 bought the site for around $5 million, which allowed for 6 apartments. Only 5 were sold on TV and for calculation purposes let’s say the acquisition costs is $4.2 million.

The construction cost and depreciation allowances totalled over $11 million, for the 5 apartments alone.

That’s $15.2 million alone in construction and acquisition costs.

It’s worth noting that under the Income Tax Assessment Act 1997 the initial vendor (ie. the developer) has an obligation to pass on the actual costs of construction to the purchaser, where the costs are known.

Let’s not forget there’s then a variety of other costs involved in buying and selling, and undertaking a property development, including:

- Stamp duty

- GST on the sale

- Demolition

- Marketing

- Agents’ fees

- Legal fees

- Interest

- Rates

Read the full article here

We pick the markets to watch + Comment about what’s ahead from Dr Andrew Wilson and Michael Yardney

Another great Real Estate Talk show produced by Kevin Turner.

Michael Yardney tell us what he saw happen in 2016 that he didn’t expect and what he sees ahead.

Geoff White from the Institute in the ACT and Greg Troughton from the REISA give their suggestions about where to buy next year.

Andrew Wilson tells us what he thinks will happen next year in Canberra – he really likes that market as you will hear and he tells us about the almost unbelievable low median in South Australia., he also gives us his solid gold market pick for 2017.

Hayden Groves highlights the trade up potential in Perth and in the Norther Territory

Quentin Killian CEO of REINT picks 2 areas there he says will be worth watching next year.

Antonia Mercorella and Tim McKibbin CEO’s of the Queensland Institute comment on what is happening there now and likely to occur next year abd tell us where the smart investment money is likely to go.

If you don’t already subscribe to this excellent weekly internet based radio show do so now by clicking here.

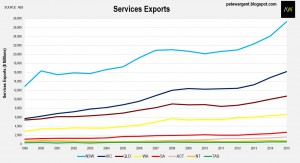

Who exports Australia’s services? (Sydney, and Melbourne)

Who is responsible for the growing rate of exporting Australian services and what affect does it really have?

This Blog by Pete Wargent, looks at the statistics behind the results.

Thanks to Sydney and Melbourne

Exports of Australian services have been growing faster than goods exports, growing by 10 per cent in 2014-15 and 9 per cent the year before that.

But which states account for the bulk of services exports?

In a nutshell, all but two thirds of services are accounted for by New South Wales (41.3 per cent) and Victoria (24.4 per cent).

Not only do the two most populous states account for most of the services exports, the growth rates are by a huge margin fastest in these two states.

Not to put too fine a point on it, Australia’s economy would be toast without its two largest cities, Sydney and Melbourne.

Read the full article here

Adding Residential Property To Your Portfolio Can Enhance Performance

Having a healthy property portfolio is the dream of every investor – but how can you enhance its performance?

According to an article in Your Investment Property Magazine the magic touch is including residential properties.

A new report by Atchison Consultants highlights how the inclusion of residential property can enhance performance in moderate, balanced and growth investment portfolios.

The report recommends property as an inclusive strategy and notes that residential property, with its relatively low volatility, provides a stable anchor to these portfolio types.

The figures, which were taken over a rolling 20-year period with different asset allocations, reveal decidedly positive results.

A growth portfolio with 20% to real property could be improved up to 9.6%, a balanced portfolio with 15% could have a 6.7% improvement, and a moderate portfolio with only 10% exposure could have a 3.7% uplift.

The data was drawn from the average allocation of super fund managers from the Australian Superannuation Survey produced by a number of data providers.

As for controlling asset allocation, Arthur Naoumidis, DomaCom Limited’s CEO, called the DomaCom platform “the ideal vehicle to control asset allocation in real property without the client’s need to borrow if that is deemed an inappropriate strategy.

Ownership can be fractionalised across multiple properties for as little as $2,000 per property so even a $10,000 allocation can achieve diversification in 5 different types of property in 5 different geographic locations.”

Click here for the full article

What your coffee says about you

Who doesn’t love a good cup of coffee?

But did you know that your favourite brew can actually say a lot about your personality?

This article on news.com.au has cracked the code to reveal just what that next latte really means.

Australians love good coffee.

Fact.

The cafe culture in Australia is only growing as is our consumption of coffee.

According to Roy Morgan Research Australian adults drink 9.2 cups per week.

So in honour of our continued love affair with good coffee we spoke to Lavazza Australia Espresso Specialist John Kozsik about what Australians drink and what it says about them.

Here is what he had to say:

Cafe Latte

Latte lovers are softer, more romantic hard workers.

Flat White

Straight-up traditionalists, at times brutally honest and they will tell you if your butt looks big in something.

Long Black

A strong, busy on-the-go person with stamina.

Cappuccino

Chocolate dusting on top means cappuccino drinkers can be indulgent.

Affogato

Want all that life has for them and don’t care what others may say.

Short Black

The purist – Straight to business.

Macchiato

Little to no fear of failure.

Piccolo Latte

Often found eating smashed avocado, piccolo latte drinkers are both health conscious and like good things in small packages.

Vienna

Usually favoured by the newly divorced or retired professional sports athlete.

Hot Mocha

Sweet and innocent, the Mocha lover prefers nothing more than cuddles on the couch.

Hot Chocolate

Reminiscent and holding a dear sense of nostalgia for their childhood.

Chai Latte

Growing up, my mother told me if I don’t have anything nice to say, don’t say nothing at all.

Caramel Latte

Often mistaken for a coffee expert, the caramel latte drinker often tells friends how much of a ‘coffee’ expert they are, rating cafes harsher than Gordon Ramsay.

Tea

Generally a Monarchist, tea drinkers enjoy whining about the cold weather while clutching a streaming cup in both hands.

Ristretto

Respect. ‘Nuff said.

Iced Coffee

The Iced Coffee drinker is good with their hands and is more often than not, a tradie.

Click here for the full article

No comments:

Post a Comment