It’s that time of year when many investors take a well earned break by booking a holiday away from home with their family or friends.

While they are away from home, property investors might be tempted by opportunities to purchase a holiday rental as an investment.

Before making a decision to dive in and purchase a property, investors should seek advice from relevant professionals such as a Property Manager, an Accountant, a Financial Advisor and a Quantity Surveyor.

This is because investors often decide to purchase a holiday rental with more than one motivation.

They not only hope to gain an income from the higher weekly rental yields that a holiday home may offer, but they also picture taking advantage of their investment by spending some of their summer holiday’s taking in the ocean views from the front patio or swimming in the backyard pool.

One common mistake holiday rental property owners make is to assume that because they are personally using the property, depreciation cannot be claimed.

This can lead many investors to miss out on thousands of dollars in lost deductions annually.

A specialist Quantity Surveyor can provide a tax depreciation schedule which is based on the portion of a year a property is available for rent, so it is best to seek advice on what deductions can be claimed before making any purchase decisions.

Ensure you claim depreciation deductions for both the building and furniture

The additional cash flow received by claiming depreciation deductions can often make the difference as to whether a holiday rental is a negative cash flow asset or a positively geared investment.

A specialist Quantity Surveyor has the expert knowledge to calculate construction costs for the purposes of depreciation.

They will perform a site inspection of the property and prepare a depreciation schedule which outlines all the deductions available including capital works deductions (for the building structure and fixed assets) and the depreciation of plant and equipment items (removable fixtures and fittings such as carpets, blinds, hot water systems and light fittings).

A specialist Quantity Surveyor will find the depreciable value of all assets within your holiday house.

These items can add thousands in extra deductions over the first couple of years alone.

Holiday house case study

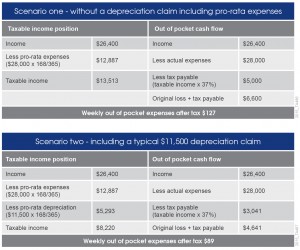

In the following example, an investor purchased a fully furnished property valued at $460,000 for use as a holiday home.

The owner rented the property to holiday makers for twenty four weeks (168 days) of the year for an average return of $1,100 per week.

For six weeks of the year they chose to use the property for personal use.

During the rest of the year, the property was untenanted.

This resulted in a total income of $26,400 per annum.

Expenses such as interest, rates and management fees totalled to $28,000.

The client was able to claim losses on a pro-rata basis for the time the property was being rented out during the first full financial year, leaving a total claimable amount of $12,887*.

They were left with a positive cash position on paper of $13,513.

By law, the client is required to pay tax on any income earned.

However, by enlisting a specialist Quantity Surveyor and claiming depreciation, this client could reduce their tax bill by an amount of $1,959 for the year.

The depreciation deductions in this case study have been calculated using the diminishing value method of depreciation and have be based on the pro-rata income and expenses the owner incurred during the first full financial year of ownership for the period the property was available for rent. *Pro-rata calculation $28,000 x 168/365 = $12,887

This investor was able to reduce their out of pocket expenses from $127 per week, down to $89 per week.

A saving of $38 weekly, even though the property was only producing income for twenty four weeks of the year.

No comments:

Post a Comment