The CoreLogic November Hedonic Home Value Index results show a rise in dwelling values across every capital city excluding Melbourne over the month.

However, the overall growth rate has moderated when compared with recent month’s performance.

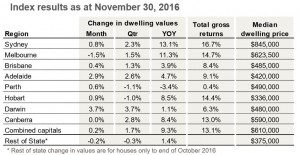

Throughout November, capital city dwelling values rose by 0.2%.

While the headline results remained in positive growth territory, the monthly capital gain reading was also the softest result since December 2015 when capital city dwelling values were unchanged over the month.

The combined regional areas of Australia showed a weaker result with house values falling by 0.2% over the month.

The November figures show that capital city dwelling values rose by 1.7% over the three months of spring; a substantial improvement over last year.

Spring 2015 saw capital city dwelling values fall by 0.2%, with auction clearance rates dipping below 60% in late November and early December.

The highest annual growth rate is evident in Sydney and Melbourne where dwelling values are now 13.1% and 11.3% higher respectively, reflecting a steeper upwards trajectory in growth over the second half of the year.

The Hobart and Canberra markets have also seen some acceleration in growth rate trends with dwelling values up 8.5%, and 8.4% respectively over the past twelve months.

For the first time since February 2015, Darwin’s annual growth rate has moved back into the black and recorded a 1.1% rise in dwelling values over the past year.

The November results also show a rise in transaction numbers across the Darwin market over recent months, supporting the moderate improvement in market conditions that the hedonic index is showing.

Currently the national growth cycle has been in play for 4.5 years, with capital city dwelling values rising by 42.2% over the cycle to date.

Rental yields reached a new record low in November across the combined capitals index due to dwelling values continuing to rise at a faster pace than weekly rental rates.

The average gross rental yield across combined capital city dwellings is now recorded at 3.2%, down from 3.5% a year ago and 4.1% five years ago.

With rental markets remaining soft, it is likely there will be further yield compression across those markets where residential property values are rising.

The only market segments where yields have improved over the past 12 months were the Hobart and Canberra unit markets where rental rates have shown a higher growth rate than unit values.

It appears as though the low yield profile is no deterrent to investors, with ABS housing finance data showing a consistent rise in finance commitments for investment purposes since May this year.

Clearly investors are continuing to see housing as the preferred investment option, despite low yields and a mature growth cycle.

Settled transaction numbers nationally have reversed their downward trend over recent months with CoreLogic estimates of settled sales rising to the highest level in a year.

With real estate agent activity across CoreLogic platforms easing over the past two weeks, it suggests that we may have moved through the peak of new listings activity.

Additionally, as we move into the first month of summer, the housing market is likely to remain active for another two weeks before we start to see the normal seasonal slowdown in buyer numbers.

After four and a half years of strong value growth, it’s hard to imagine a reacceleration in property values could be long lived.

Affordability constraints are creating high barriers to entry, particularly in Sydney, and lenders are becoming more cautious in their lending practices.

The supply pipeline is substantial for inner city units, which is likely to dampen value growth in these precincts as well as dent buyer confidence and push vacancy rates higher.

Additionally, buyer enthusiasm could be muffled by speculation that interest rates may rise late next year, with fixed rates already starting to edge higher.

With household debt at record levels, Australians are very sensitive to the cost of debt, and an expectation that the period of record low mortgage rates is approaching an end may reduce buyer demand.

No comments:

Post a Comment