In times gone by it was fairly common for real estate investors to look for investment properties close to where they lived.

There isn’t necessarily anything wrong with that, depending, of course, on where you live!

But today let’s look at a more strategic approach to investing in property.

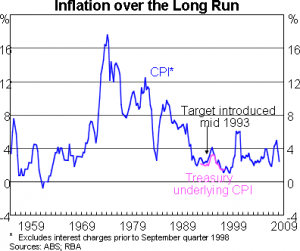

Through the 1970s and 1980s, Australia experienced prolonged periods of high inflation as evidenced in the chart below:

This effectively devalued mortgage debt and so virtually anyone who adopted an approach of borrowing to invest in an asset such as property over anything even approaching a reasonable time horizon came out well ahead.

You will note from the graph that Australia’s Reserve Bank (RBA) adopted an inflation target in 1993. Since that time, inflation has been notably lower.

While the future with regards to inflation is always somewhat uncertain, it seems to be a reasonable assumption that inflation in the future is likely to be consistently lower than was seen through those earlier decades.

For this reason, I believe it is no longer likely that simply by investing in property “in your own backyard” is going to be good enough to secure your financial future.

Invest through two full property cycles for wealth

Building wealth through property investment isn’t necessarily easy, but the fundamental concept can be very simple.

The investment approach which is successful most often for most average investors is to invest in a property which appreciates in value and then, rather than selling that property to “lock in” the investment profits, to refinance the property and use some of the equity that has been created to invest in further investment properties.

Then over the coming years when the newly-acquired properties also appreciate in value, significant equity will have been created which the investor may use for whatever purposes are deemed appropriate.

Some will then liquidate the investment properties to invest in so-called “income assets” such as high-yielding shares or fixed-income investments, including investment grade corporate notes or bonds and term deposits.

Others will simply draw out a portion of the equity for living costs.

Often a hybrid approach is used, such as selling some of the properties in order to extinguish some of the debt while retaining a number of properties for the future.

Aggressive investors who are less risk averse may look to refinance several properties to invest in yet further properties.

The in-built assumption

Of course, you will have spotted the in-built assumption in the approaches discussed above: that property always goes up in value. This is by no means necessarily the case.

Indeed, while it was possible in earlier decades to more or less buy any property and see it ‘appreciate’ (or was it often the case that mortgage debt was inflated away?) markedly due to high levels of inflation, this may not continue to be the case in the future.

Consequently, investors may need to adopt a slightly different approach to those that worked in the past.

The first thing that investors might look to do is to invest in a different city or state to the one in which they live.

Counter-cyclical investing

Smart investors will look to invest counter-cyclically through seeking out a city or region which has not recently experienced growth in order to capitalise on the next growth cycle.

Thus, investors today might be more inclined to look away from Melbourne than they would have been in, say, 2007, for since that time there has been an enormous boom in values.

While the long-term fundamentals of the city such as population growth and a diversified range of industries look great, Melbourne is unlikely to be the next major capital city to boom in value.

Variously, cases might be made for Brisbane, due to the city having experienced lacklustre growth for more than half a decade now, or my preferred long-term choice, Sydney’s inner and middle-ring suburbs.

That said, if you told me that Perth was tomorrow’s hotspot due to its sharp population growth, its strong growth in resources-based Gross State Product and real wages, I would find it hard to disagree with you.

From Macro to Micro

In the world of economics there are two main forms of economist: macro and micro.

Macro economists, as the term suggests (from the Greek makros, meaning large) tend to focus on the big economic picture such as a government’s policy decisions, the national level of unemployment or, for example, the prevailing rate of inflation.

As a historian specialising in industrial and economic history, I am interested in macro trends, and the effect of government (and central bank) policy on the economic health and wealth of nations.

So in that respect, you would say that in my specialist field I adopt a macro or “top down” approach.

On the other hand, micro economists (micros being the Greek work for small) focus more upon the day-to-day decision-making processes of individual businesses or households.

Micro economists may be more interested in the field of applied economics, becoming experts in one specific field such as experts on Goods and Sales Tax (GST) or a particular type of commodity.

Social economic historians tend to be more interested in developments to this level of micro-detail, looking at how the universal laws of supply and demand impact upon individual circumstances.

They may often adopt a highly statistical or price-based approach to their studies.

Property investors as macro and micro experts

As I alluded to above, I would suggest that if you want to become a property millionaire – and there are plenty out there who do – to achieve this goal today, you need to become a macro expert and a micro expert.

What do I mean by that?

As I explained above, future property price growth in Australia (in my opinion) is likely to be materially lower than it was in the past.

Therefore, if you want to become wealthy through property it is important to be able to identify property cycles and to invest in whichever city you deem has the best prospects for growth.

Remember: look beyond your own back yard!

This is where your macro-expertise comes in!

Identify population growth trends, prosperous cities with a range of industries and real wages growth, and, importantly, cities which have not experienced a boom in growth in recent times.

Then, using a top down approach, you need to become a micro expert in that city by first finding the property types and then the specific streets and individual properties that will strongly outperform the misleading “median price growth” so beloved of the financial press.

If you are able to do this and can invest in a property which booms in value, you then need to turn your focus away from the city which has served you so well, to seek out the next boom location.

Re-draw some equity and move on to re-investing in further properties.

If you can successfully select another boom location and hold your newly-acquired investment properties through another growth cycle you will be well on the way to wealth through property investment.

So, remember the top down approach: start with the state, then the city, then the suburb, the street and the individual property.

From macro to micro, you will be on that elusive road to financial success.

No comments:

Post a Comment