Earlier this week the Reserve Bank (RBA) held their first monetary policy meeting of 2017.

At the meeting, the RBA board decided to keep official interest rates on hold at 1.5%.

In their statement following the meeting the RBA noted that the global economy has improved over recent months and that this has led to higher commodity prices.

The statement also noted that the RBA expects the December 2016 GDP figures to show ‘reasonable growth’ following a weaker than expected result over the September 2016 quarter.

Although the statement recognises the recent increase in unemployment, it notes the recent pick-up in full-time employment and states that the RBA expects employment to expand further.

The statement also notes inflation remains weak, but highlights the RBA expects headline inflation to pick-up to above 2% this year however, an improvement in underlying inflation will take longer.

Very little has changed with regards to the RBA’s view on the housing market; they note the ‘brisk’ value growth in certain markets and highlighted for the first time this month the very weak rental growth.

The statement indicates that the RBA still believes the historically high pipeline of units under construction will slow growth in the market as they come online.

The statement also indicates that the RBA believes that lenders are taking a more cautious approach in lending to certain segments.

Overall, the RBA statement following the ‘hold’ decision suggests a stable cash rate for the immediate future, however mortgage rates have already edged higher due to higher bank funding costs, despite the steadiness in the cash rate since August last year.

The Australian Bureau of Statistics (ABS) released retail trade data for December 2016 earlier this week.

The data revealed that retail trade fell in December 2016, down -0.1%.

It was the first time retail trade had fallen in December since 2009, indicating that the retail sector was relatively weak in the lead-up to Christmas. Retail trade feel over the month in NSW, Vic and the ACT and was unchanged in Qld.

In all other states and territories trade was higher over the month but the weakness in the three largest states was enough to drive retail trade lower nationally

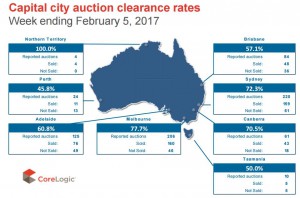

Last week, CoreLogic collected results for 82.9% of all capital city auctions.

Based on these results, the final combined capital city auction clearance rate was recorded at 68.8% across 881 total auctions.

The clearance rate fell from 71.6% the previous week, while auction volumes rose from 368.

In Melbourne, last week’s clearance rate was 77.7% across 261 auctions, down from 82.4% from 137 auctions the previous week.

Sydney’s auction clearance rate was recorded at 72.3% last week from 259 auctions which was down from 76.6% across 84 auctions the previous week.

Auction volumes remain quite low however, they were higher over the week in Sydney and Melbourne as auction markets continue to ramp up after the seasonal slowdown.

It will be interesting to see whether clearance rates hold at around their current levels over coming weeks as auction volumes rise, or whether they fall further.

Note that sales listings are based on a rolling 28 day count of unique properties that have been advertised for sale

The number of new residential properties advertised for sale have increased significantly from their seasonally low base over the past several weeks.

Over the 28 days to February 5, there have been 42,563 newly advertised properties for sale nationally and 26,108 across the combined capital cities.

Despite the significant weekly rise, the number of new advertisements are -10.4% lower over the year nationally and -4.8% lower across the combined capital cities.

Newly advertised properties for sale are lower than they were a year ago across all capital cities except Sydney (+9.1%) and Canberra (+0.1%).

There was a total of 222,816 properties advertised for sale over the past 28 days and 96,988 of these were within capital cities.

The total number of properties for sale is -6.9% lower over the year nationally and -2.2% lower across the combined capital cities.

The number of properties advertised for sale are higher than a year ago in Brisbane (+6.3%), Adelaide (0.9%) and Perth (+2.1%) but are lower across all other capital cities.

No comments:

Post a Comment