You’ll often read that Australian property cycles last 7-10 years – But is this actually true?

Well…not really.

In a moment I’ll share Shane Oliver, the Chief Economist at AMP Capital’s thoughts on this, but first some context:

The property cycle isn’t easy to read.

The various phases are not clearly defined and the length of each cycle and its various stages varies from cycle to cycle.

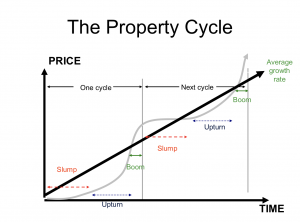

However, the following graph shows what could happen over two property cycles.

The thick black line shows how “on average” property values increase over time, because well-located capital city properties tend to double in value every 10 years or so.

Then there is an upturn phase where property values increase slowly but steadily.

But the curved grey line shows that at times the value of properties in a region remains flat for a number of years (or even drops in value) – this is the slump stage of the property cycle.

And finally the shortest phase of the property cycle is the boom stage when property values overshoot their natural levels.

You can see that at various stages in the cycle property values exceed the underlying long-term trend (such as in boom times) and at other stages they fall short of the long-term underlying value, such as during property slumps.

As I said, the length of each property cycle varies and is not always seven to 10 years as is often suggested.

This is because cycles don’t occur simply because a certain number of years have passed, they occur because of a combination of macro and micro economic factors and the interplay of several social and political issues.

A while ago AMP Capital’s chief economist, Shane Oliver, explored this topic and explained what causes property cycles to change over time.

Q: Shane, what is meant by the seven year property cycle? What are the different phases?

A: The “seven year property cycle” is often referred to by property market commentators and refers to the swing in house prices through the phases of boom, bust, bottoming and recovery.

But it’s rarely seven years.

In fact, average Australian capital city prices have had multiple cycles over the last 15 years with booms around 2003, 2007, 2010 and just recently.

The cycle is better seen in terms of the rate of property growth, as not all downturns or bust phases have price declines, but rather just a slowing.

The cycle can also vary from city to city, with only Sydney and Melbourne being in boom phases recently, and also within cities.

Q: What factors influence this?

A: The main factor driving the property cycle is the cycle in interest rates, with periods of rate cuts eventually driving upswings in the property cycle and vice versa for rate hikes.

Around this, the supply of and demand for property also has an impact, along with job security and unemployment.

Q: What is the rule of 72? Is this accurate in predicting how long it takes for a property or area to double in value?

A: It’s a short cut to understand how compounding works.

It’s actually quite useful because it all depends on the growth rate or interest rate (which in the case of compounding is the same thing).

Because it depends on the growth rate, it allows for the impact of a shift from a higher growth world to a lower growth world.

But now in a world of lower inflation and wages growth, property price growth over the last decade has slowed down to an average of just 6% pa, which means they are doubling in value roughly every 12 years.For example, when inflation and growth in wages was higher in the 1980s, property prices averaged growth of around 11.5% pa, which meant they would double in value roughly every 6.3 years.

So it’s a mental arithmetic shortcut for investors to use: 6 X 12 = 72 (hence, the ‘72 rule’).

Q: Do you believe that if people haven’t been through a full property cycle then they can’t really know real estate markets?

A: No. People can understand how real estate markets work by doing their homework.

They need to look at past property cycles to gain an understanding of how the cycle works and how it interacts with interest rates and other variables.

Unfortunately, as with other investment markets, people tend to get lured by property at the worst point in the cycle, after it has already had a strong gain and is more expensive.

No comments:

Post a Comment