Capital city dwelling values rose a further 1.4% in February, with Sydney continuing as the overall capital gains leader.

The monthly CoreLogic Hedonic Home Value Index reported a further rise in the value of capital city dwellings in February, with values rising 1.4% over the month.

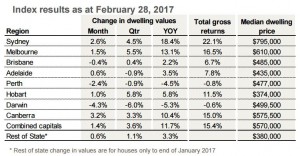

The strong capital gain over February was led by Canberra (+3.2%) and Sydney (+2.6%), with Melbourne (+1.5%) and Hobart (+1.0%) also returning significant increases.

At a combined capital city level, growth conditions have been rebounding since the middle of last year when, on two separate occasions, interest rates were cut, and investor demand commenced trending higher.

Prior to capital gains accelerating half way through last year, the growth trend had been moderating, reaching a cyclical low point over the twelve months ended July 2016 when the annual change in capital city dwelling values slowed to 6.1%.

The February results mark a new high point in the current growth cycle, with capital city dwelling values increasing by 11.7% over the past twelve months.

The annual growth rate across the combined capitals hasn’t been this strong since the twelve months ending June 2010.

In Sydney, where the annual rate of growth is now 18.4%, this is the highest annual growth rate since the twelve months ending December 2002 when the housing boom of the early 2000’s started to slow.

The latest CoreLogic results take the current housing growth cycle into its 58th month.

Since capital city dwelling values started to rise in June 2012, dwelling values have increased by a cumulative 47.3%, ranging from a 74.9% capital gain in Sydney, to a net rise of 6.0% in Perth.

While dwelling values continued to rise, weekly rents remained comparatively soft.

As a result, downward pressure has been placed on rental yields.

The average dwelling yield across the combined capital cities fell to 3.2% over the month, which is a new record low.

Five years ago, the average capital city yield was a full percentage point higher at 4.2%.

Despite the record low rental yields on offer, investor demand remains high, suggesting investors are likely to be relying on a negative gearing strategy to compensate for their cash flow losses.

It also indicates that investors are speculating on future capital gains.

The latest housing finance data from the Australian Bureau of Statistics indicates that investors comprise approximately 57% of new mortgage demand across New South Wales (excluding refinanced loans).

This is substantially higher than the long run average, which is slightly above one third

The renewed strength in the housing market is corroborated by a range of other data points such as auction results, low advertised stock levels and rapid selling times.

According to CoreLogic auction results, 2017 began on a very strong footing with capital city clearance rates generally tracking in the high 70% to mid-80% range from week to week.

The results of ‘Super Saturday’ last week saw an unprecedented number of auctions for February; clearance rates reached a new high for 2017 despite the large number of auctions held.

Advertised listing numbers remain low across the hottest housing markets, with total residential advertised listings in Sydney tracking 11.3% lower than the same period a year ago, Melbourne total listings are 5.1% lower than last year, Hobart listings are down by 35% and Canberra advertised stock levels are 6.2% lower than a year ago.

Low levels of advertised stock for sale at a time when buyer demand remains strong is creating a sense of urgency among buyers, which is adding to the upward pressure on prices.

This helps to explain why clearance rates are so high, and private treaty sales are so rapid across the strongest markets.

Overall, the latest results from the CoreLogic Hedonic Index highlights the performance diversity across Australia’s housing market.

The continuation of the capital gains rebound is likely to create further discomfort among policy makers, particularly in light of the growing debate around affordability and the high level of demand from investors.

I remain of the view that housing market conditions will moderate during 2017 due to affordability constraints impacting on housing demand, as well as higher supply levels and an eventual slowing of investment demand brought about either through changed policies from Australian lenders or via regulatory changes aimed at slowing credit growth across the investment sector.

No comments:

Post a Comment