According to CoreLogic research, with recent record-high new housing construction levels coupled with investor mortgage activity, the supply of housing stock available for rent is climbing higher.

As Australia’s population continues to grow, here’s a look at how rental listings are tracking.

Over recent years, the uplift in population growth has not been met with a commensurate rise in property sales.

Rental advertisement counts suggest that the population growth is increasingly being housed via rental housing which aligns with the lift in investor housing finance commitments over recent years.

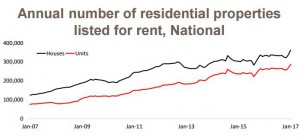

Over the 12 months to January 2017, there were 362,708 houses advertised for rent and 287,233 units at a national level.

The number of rental advertisements over the past year grew 8.7% higher for houses and 9.3% higher for units.

The rental market is currently seeing historic low rates of rental growth.

With the amount of rental accommodation ramping up, it’s easy to see why.

Keep in mind this data is only those properties advertised for rent and not every rental property will be advertised for rent each year.

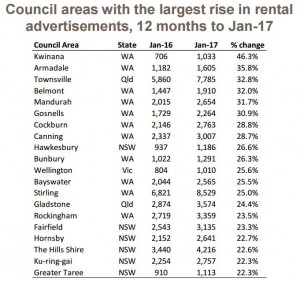

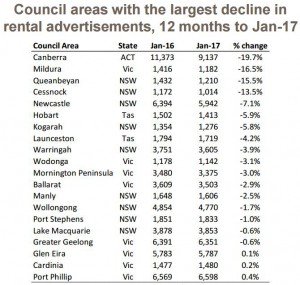

(Note: The adjacent tables show those council areas that have seen the greatest increases and decreases in rental advertisements over the past year. CoreLogic has only included council areas that have had at least 1,000 rental advertisements over the 12 months to January 2017.)

Council areas within Western Australia feature heavily on the list of regions to see the greatest increase in rental advertisements over the year, many of which are located in Perth.

Investor activity has been sluggish in WA so this may indicate that as the economy has weakened and people have migrated away from WA, perhaps home owners are looking to rent out their home rather than selling into weak market conditions.

A number of NSW regions are also featured on the list and this is probably more reflective of the ramping-up of housing supply purchased by investors.

Of those regions with at least 1,000 rental advertisements over the past year, only 17 council areas have actually seen a decline in rental advertisements over the year.

Two of the improving housing markets for value growth, Canberra and Hobart, are amongst these 17 council areas.

The areas with less rental stock advertised than a year ago also tend to be more slanted towards regional areas rather than capital cities.

This is not surprising given that housing supply has largely been increasing in capital cities rather than regional markets.

Despite the housing construction boom in Sydney at the moment, Kogarah, Warringah and Manly have recorded fewer properties advertised this year compared to last year, signaling tighter rental conditions.

With a record high number of new dwellings still under construction, most of which are units and many of which have been purchased by investors, CoreLogic anticipates that the number of properties advertised for rent will continue to rise.

The impact of this is that rental growth is likely to remain dampened and those in the rental market in most regions will have an increasing number of properties to choose from.

For owners of investment properties and property managers, they should be mindful of their local rental conditions, and set their weekly rents accordingly to maximize their occupancy as well as income.

Landlords in areas where the supply of rental properties has shown a rise may find they need to hold their rents steady or in fact, provide a discount on their rental expectations in order to keep or attract tenants.

No comments:

Post a Comment