Property items that increase tax deductions.

Whether you’re on the hunt for your first investment property, you’re a Mum and Dad investor who owns just one rental property or you have a large property portfolio, it’s worth paying attention to the assets contained inside and outside a building.

Each of the assets you see not only will impact the value of the property; they can also result in substantial tax deductions.

This is because legislation allows income producing property owners to claim depreciation deductions for structural items and for the plant and equipment assets contained within the building.

To examine the true value that plant and equipment assets have for investment property owners, we took a look at some of the most common depreciable assets BMT Tax Depreciation’s expert staff find within residential properties.

Among the most common depreciable assets found are split system air conditioners, blinds, garbage bins and smoke alarms.

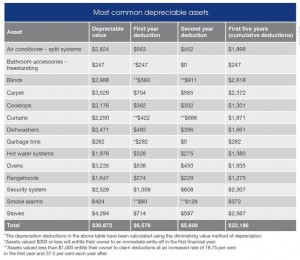

A summary of the depreciation deductions found over the first five years for fourteen of the most common assets is outlined in the table below.

However, a security system valued at $2,529 will result in the largest first year deduction of $1,009.

Over the first five years, blinds provide the most cumulative deductions, with $2,618 able to be claimed over this time.

While several of the assets (such as the bathroom accessories, the garbage bins and the smoke alarms) have a relatively low depreciable value, the claim in the first year is still significant as items worth less than $300 will entitle the owner to an immediate write-off while assets worth less than $1,000 can be added to the low-value pool.

Similarly, blinds and curtains are often considered part of a set, so each individual blind or curtain can be added to the low-value pool and depreciated at an increased rate.

The owner of a property which contained all of the above assets could claim $6,576 in deductions in the first year alone and $22,186 in cumulative deductions over the first five years.

While the above assets represent those commonly found, they are by no means a complete and comprehensive list.

There are more than 6,000 assets recognised by the Australian Taxation Office as depreciable items.

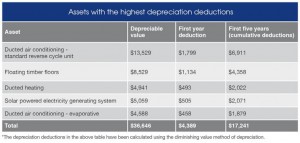

By examining some of the plant and equipment assets BMT find that result in the highest depreciation deduction for property investors, we gain additional insight into why it is so important to consult with an expert to ensure your deductions are maximised.

Many of the items which provide significant depreciation deductions (for example ducted air conditioners and floating timber floors) are also not that uncommon in investment properties.

The table below outlines example deductions for five of the assets which result in the highest deductions for their owners.

No comments:

Post a Comment