In Melbourne, house values were 17.2% higher over the past twelve months compared with a 5.2% increase across the unit sector.

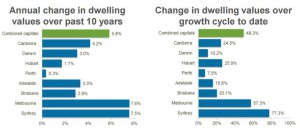

Melbourne’s property market has continued to produce high levels of capital gains for investors.

Dwelling values have surged by 15.9% over the past twelve months, mostly during by the strong conditions in detached housing where values are 17.2% higher over the past twelve months compared with a much lower 5.2% gain in unit values.

The gross yield on a Melbourne dwelling is now 2.8%.

While some rental markets have recently seen a rise in the pace of rental growth, generally, the trend in rental appreciation remained soft in comparison with the rate of capital gains; growth in dwelling values is substantially outpacing rental growth in Sydney and Melbourne and gross rental yields have again slipped to record lows in these cities.

Despite the high capital gains, Melbourne dwelling prices remained about $200,000 or 25% lower than Sydney’s based on median prices.

Homes are selling in approximately 30 days across Sydney and Melbourne, while discounting rates are well below 5.0% in these markets as well.

No comments:

Post a Comment