Property prices accelerated over the past year, spurred on by the RBA’s rate cuts in May and August 2016.

As a result, the twin issues of housing affordability and financial stability have been front of mind for Governments, the RBA and APRA, yet our real estate markets have remained stubbornly strong, but there are now signs suggesting that price growth will slow from here.

While property price growth will moderate I still expect property prices to grow, so let’s dig deeper and unpack the latest CoreLogic chart pack…

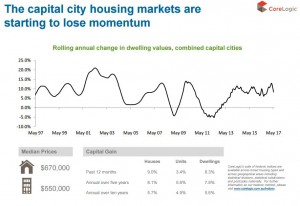

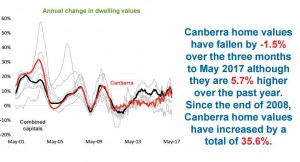

Capital city dwelling values fall in the traditional seasonally weak month of May

- Combined capital city dwelling values fell by -1.1% in May with values declining in all capital cities except for Brisbane and Adelaide.

- It should be noted that May falls are a common occurrence in the Index which is not seasonally adjusted, in fact values have fallen in May four of the past five years.

- Over the past three months, values rose 0.4% with rises in Sydney, Melbourne, Brisbane and Adelaide but falls elsewhere.

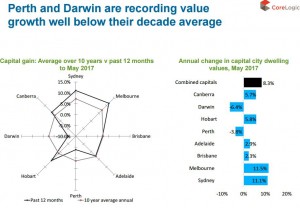

- Across the individual capital cities, the annual change in home values have been recorded at +16.0% in Sydney, +15.3% in Melbourne, +2.1% in Brisbane, +2.2% in Adelaide, -6.0% in Perth, +13.6% in Hobart, -2.3% in Darwin and +8.4% in Canberra.

- Although May is a seasonally weak month, other data sets point to some of the heat having come out of the housing market recently.

What the chart above doesn’t really show is who fragmented our property markets are – the Melbourne property market has been the strongest growing property market, not only over the last 12 months, and Sydney came in a close second:

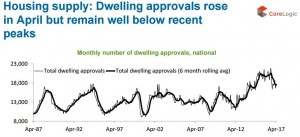

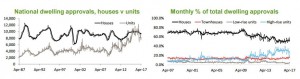

The potential oversupply of apartments remains a key concern.

Especially in Melbourne and Brisbane, where approvals have added 40-50% of the total apartment stock over the past five years.

Both cities have around 1½ years worth of construction already underway, almost double the average backlog prior to the global financial crisis.

This expected increase in supply is particularly concerning in Brisbane, given their population growth has slowed right down.

Whereas the strong Melbourne population growth has meant the predicted oversupply may not be such a big issue.

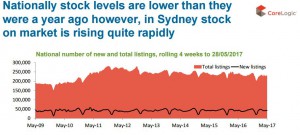

Otherwise there are fewer properties for sale.

The number of properties advertised for sale is lower than a year ago nationally and at a similar level nationally

- The number of new properties advertised for sale is -1.0% lower than a year ago nationally but 1.5% higher across the combined capital cities.

- Brisbane, Adelaide and Perth are the only capital cities to currently have fewer new listings than they had a year ago.

- Over the past 28 days, total advertised properties were -4.1% lower than a year ago nationally and were unchanged across the combined capital cities.

- Melbourne, Perth, Hobart and Darwin were the only capital cities to have fewer homes advertised for sale currently than they did 12 months ago.

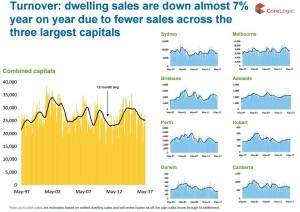

Settled house and unit sales continue to trend much lower in the largest capital cities

- It is estimated that there were 301,891 settled sales of capital city dwellings over the 12 months to May 2017 with the number of settled sales -6.9% lower over the year.

- Both house and unit sales have fallen over the past year.

- Transaction volumes have fallen over the year in Sydney, Melbourne, Brisbane and Canberra and risen across the remaining capital cities.

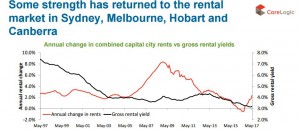

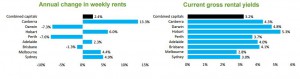

Rental growth is picking up

Until recently rental growth has been sluggish but it is now picking up, particularly in the markets where dwelling value growth has been stronger

- Combined capital city rents have increased by 2.3% over the 12 months to May 2017 which is the fastest rate of rental growth since March 2014.

- Rental rates have continued to fall over the past year in Brisbane, Perth and Darwin however, rental growth has accelerated over the year in all other capital cities.

-

Coupled with rising house price growth, rental yields had fallen to the lowest level on record but last month gross rental yields edged slightly higher and are now recorded at 3.2% across the combined capital cities.

• It is likely that rent inflation will remain subdued over the near term, given the strong volume of supply currently under construction and due to come to market over the next few years.

•Given soft rental price growth and strong house price growth over the past year, it has become increasingly more affordable to rent, rather than buy.

Auction clearance rates remain strong but have eased from their recent highs

- Last week, clearance rates were recorded at 71.3% which was their lowest level in five weeks and the third lowest read of the year.

- Sydney’s clearance rate last week was its third lowest of the year while Melbourne had its lowest clearance rate of the year.

- Earlier in the year Sydney and Melbourne have had clearance rates above 80%, although the clearance rates still point to market growth they aren’t quite as strong as they have been.

The markets remain stubbornly strong

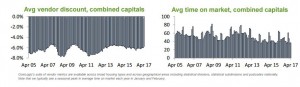

Discounting levels are falling while days on the market is creeping slightly higher

- The typical capital city dwelling which sells for less than its initial list price is being discounted by 5.7% which is the lowest level of discounting since March 2015.

- Discounting levels are lower over the year in Sydney, Melbourne, Brisbane, Adelaide, Hobart and Canberra and are higher elsewhere.

- The typical capital city dwelling is taking 37 days to sell which is slightly higher over the month but lower than the 45 days it took to sell a year ago.

- The days on market figure is higher over the year in Brisbane, Perth and Darwin but lower elsewhere.

APRA IS HAVING AN ONGOING BATTLE

APRA and governments have implemented further measures aimed at improving housing affordability and financial stability.

While initially these macro prudential controls seemed to be slowing down investor lending, investors are again dominating our property markets:

As you can see from the chart below investors still make up 46.5% of lending in NSW and a high proportion in Victoria and also in the Northern Territory.

WHAT’S HAPPENING AROUND THE STATES?

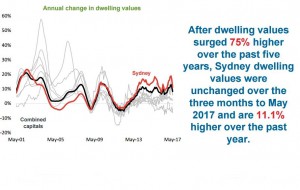

Even though there was no overall growth over the last quarter in Sydney, = Sydney property values grew 11.1% in the last 12 months.

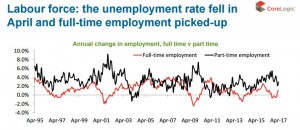

Last year Sydney created 54,193 new jobs – almost a third of all the new jobs around the country and Sydney has consistently seen low months of supply over recent years, so the underlying fundamentals are still strong.

The market is just taking a well deserved breather after it’s massive run up and price growth is likely to moderate over the balance of this year.

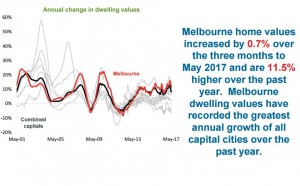

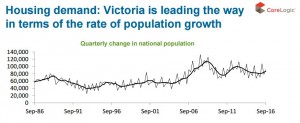

Strong population growth (around 2% per annum) and a strong economy creating around 72,786 jobs – most of them full time jobs – (almost half the new jobs in the country) have underpinned the Melbourne property market.

And once again the strong auction clearance rates show the underlying strength of the local market.

This will be boosted in the second half of this year as the First Home Buyers Grant works its way through the market creating an established home owner’s boost as the raft of new home buyers enter the market buying up established apartments.

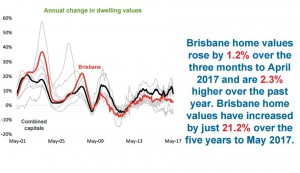

However the Brisbane market is very fragmented and there are still some areas that are performing respectably and have good investment prospects.

On the other hand, there is a significant oversupply of new high rise off the plan apartments overshadowing the inner city area and nearby suburbs.

Employment growth is ticking up in Queensland which created close to 18,000 new jobs last year.

Brisbane currently has 5.1 months of established housing stock available for sale.

The months of supply figure is higher than it has been at this time of year for each of the past five years.

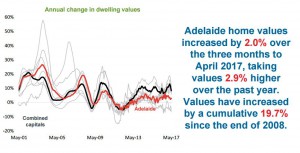

There are few growth drivers in Adelaide with fewer than 8,000 new jobs created there last year.

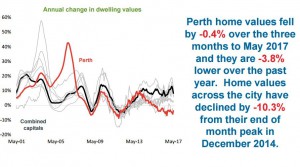

The Perth property market is still in its slump with a significant oversupply of properties for sale.

As opposed to the eastern states where jobs are being created, Perth lost around 4,406 jobs last year.

At the moment there is 8.3 months of established housing stock available for sale in Perth.

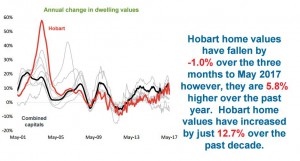

Even though some commentators are suggesting it’s a good place to invest, I don’t agree and the latest figures show the property run in Hobart was short lived.

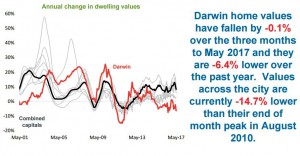

The Darwin property market is still suffering from the effects of the end of our mining boom.

Prices are still falling and they’re likely to keep falling for much of this year.

I’ve always found investor driven markets more volatile than our big capital cities and that’s why I avoid them.

Darwin had a net increase of 153 jobs last year, showing how its economy is languishing

ECONOMIC DATA REMAINS MIXED

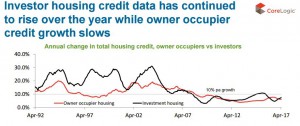

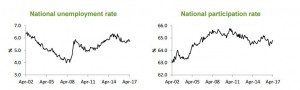

Economic data suggests that demand from the investor segment of the housing market may be slowing

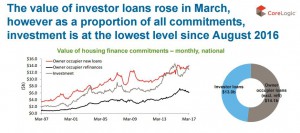

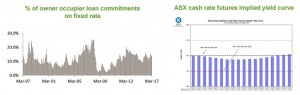

Housing credit growth picked up in March 2017 with investor demand continuing to rise on an annual basis however, monthly data shows that investor credit growth has started to slow.

The value of new mortgage lendin

Broader economic data also has a significant impact on housing market conditions

Housing investment is much more prevalent in NSW than in all other states and territories, in fact Vic is the only other state where investors make-up more than 35% of the total market.

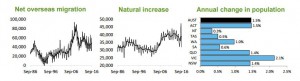

Interstate and overseas migration into NSW and Victoria is substantially stronger than all other states and territories adding to housing demand.

More granular internal migration data released recently shows that net internal migration to Melbourne and Brisbane is the greatest it’s been in at least 10 years while Sydney’s internal migration was the lowest since 2011-12.

The number of dwellings approved for construction increased by 4.4% in April.

Approvals remain high on an historic basis however, they are 20.4% lower now than at their recent peak.

We’re at the peak of the construction cycle with dwelling approvals tapering off.

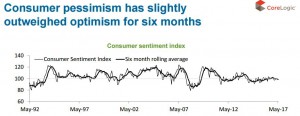

Consumer sentiment remains at a level which is slightly below neutral however, negative sentiment has outweighed positive over each of the past six months.

As you can see from the charts below, there is a strong link between consumer sentiment and the strength of our property markets.

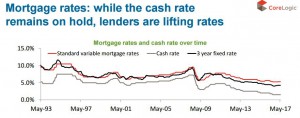

The RBA kept interest rate on hold again in June however, yet many lenders have lifter mortgage rates independently of a shift from the RBA.

The value of owner occupier and investor housing finance commitments both rose in May however, the value of each remains below recent highs.

The latest housing credit data shows that investor housing demand is still rising measured on annual growth however, monthly credit growth continues to decelerate.

THE BOTTOM LINE…

Despite our low interest rate environment, Australia’s property markets are very fragmented and driven by local factors including jobs growth, population growth, consumer confidence and supply and demand.

The Melbourne and Sydney property markets are continuing to outperform the other states as continuing demand from investors and wealthy home owners drives capital growth.

However this is likely to moderate in future months and at this mature stage of the proeprty cycle careful property selection will be critical for investors as our markets are very fragmented and not all properties are growing strongly in value and some will make very poor long term investment choices.

WHAT CAN YOU DO TO STAY AHEAD?

As signs point to softer growth conditions for Australian property over the coming months, independent professional advice and careful consideration will be as important as ever in navigating Australia’s varied market conditions.

If you’re looking for independent advice, no one can help you quite like the independent property investment strategists at Metropole.

Remember the multi award winning team of property investment strategists at Metropole have no properties to sell, so their advice is unbiased.Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

Please click here to organise a time for a chat. Or call us on 1300 20 30 30.

When you attend our offices in Melbourne, Sydney or Brisbane you will receive a free copy of my latest 2 x DVD program Building Wealth through Property Investment in the new Economy valued at $49.

No comments:

Post a Comment