There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

Hiking foreign buyer fees ‘totally defies economic logic’: Industry experts

What are the real side affects following changes to fees for foreign investment buyers in NSW?

It would seem that property experts are questioning the logic behind the decision – which raises concern for the of foreign investment in the state.

An article on Domain.com.au takes a deeper look into the debate.

A decision to charge foreign investors buying in NSW the highest fees in the country, in addition to federal budget measures, has been slammed by real estate pundits as a move that “totally defies economic logic” and will make affordability issues worse.

The NSW budget is set to double the stamp duty for foreign buyers to 8 per cent and increase land tax from 0.75 per cent to 2 per cent, which will cost offshore buyers tens of thousands in additional fees.

These additional funds are being redirected to fund housing affordability measures, including reduced stamp duty for first-home buyers.

But the measures could actually see affordability issues made worse, explained Sue Jong, chief operations officer of Chinese real estate portal Juwai.

“This policy could decrease foreign investment in NSW new property by as much as 15 per cent,” Ms Jong said.

But while it’s likely to reduce demand, it could also cause a decrease in supply.

“With every misguided new policy proposal, foreign investment will decrease along with new housing construction, housing affordability and construction employment,” Ms Jong said.

“For every unit a foreign buyer purchases, they enable developers to build four more homes for first-time buyers and investors.”

The top Sydney suburbs by Chinese buyer inquiries to the platform were Castlecrag, Sydney CBD, Riverstone/Marsden Park, Pyrmont, Ryde, Waterloo, Moore Park, Rhodes, Epping, Burwood and Point Piper.

There were concerns foreign investors might consider other states and territories where fees were lower.

In Victoria, there is a 7 per cent stamp duty charge and 1.5 per cent land tax for foreign buyers.

In Queensland, there is a 3 per cent surcharge.

Perth may also have a future surcharge on foreign investment of 4 per cent.

But Richardson & Wrench Mosman director Robert Simeon said the measures the state budget was set to introduce would not be significant alone.

Read the full article here

Where not to buy in the USA + Be ‘kind’ to valuers + The ‘funny’ things we are told about money

Another great Real Estate Talk show produced by Kevin Turner.

Michael Yardney discusses how money CAN make you happy.

Andrew Mirams discusses if you can manipulate or influence a bank valuation.

Jane Slack-Smith explains everything you need to know about renovations.

Steve Earl looks at where to buy and where NOT to buy in the USA.

John Lindeman discusses what could turn the WA market around.

If you don’t already subscribe to this excellent weekly internet based radio show do so now by clicking here.

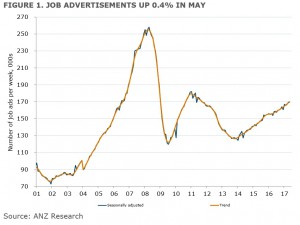

6-year high for job ads

Job advertisements continue to rise month on month.

This Blog by Pete Wargent shows the statistics behind the results.

Job advertisements rose for a third consecutive month, rising by 0.4 per cent in May.

Ads are now 8.1 per cent higher than a year ago in trend terms, signalling a steadily improving labour market.

Indeed total advertisements are now at their highest level since August 2011 at just shy of 170,000.

GDP to be moderately positive

In other news the ABS Business Indicators figures showed inventories rising by 1.2 per cent in the first quarter – mainly due to mining inventories, of course – to be 2.5 per cent over the year.

With inventories likely to add about 0.44ppts to GDP growth in the first quarter, all the talk of a ‘technical recession’ in recent days is likely to recede.

In reality, real GDP growth is not likely to be the best measure of performance over the first half of 2017, with commodity prices relatively high in the first quarter, but weakening in the second.

Read the full article here

ANZ: The days of rapid house price growth in Australia are over

The topic of rising house prices seems to be top of mind for most Australians, particularly in Sydney and Melbourne – but it would seem we may be entering a slowdown.

According to an article on Business Insider – results from ANZ, show that the end of house price growth could be around the corner.

After years or rollicking growth, led by Australia’s largest cities Sydney and Melbourne, Australian house price growth is expected to slow sharply over the next two years, says ANZ.

In a note released earlier this week, the bank says growth will slow sharply due to higher interest rates and tighter macroprudential regulation, providing some comfort for regulators and politicians who are currently grappling with increased financial risks and growing community concern over housing affordability, particularly in the nation’s largest cities.

“The combination of further regulation and changes to government policy, tighter borrowing conditions and out of cycle mortgage rate increases are all expected to weigh on the outlook for prices,” said Daniel Gradwell and Jo Masters, senior economists at ANZ.

“We anticipate nationwide dwelling prices will rise by 4.4% year-on-year through 2017, before slowing further to 1.9% year-on-year in 2018.”

Recent data from CoreLogic revealed house prices fell across most Australian capitals in May, seeing annual growth across the country slow sharply from levels reported earlier in the year.

The expected slowdown is shown in this chart from ANZ, showing recent growth in house prices across Australia’s capitals, along with where price growth is likely to head in its opinion.

Source: ANZ

While Gradwell and Masters see a pronounced slowdown across most capitals over the next two years, and even price declines in Perth, Darwin and Brisbane, they suggest that factors such as population growth and housing supply will continue to exert influence on individual markets, continuing the uneven price performance seen in recent years.

Read the full article here

Bedroom decor tips for a better night’s sleep

A good night sleep is a key element to having a successful day and being your best self.

But if you’re having trouble getting the perfect night’s sleep – the problem could be your bedroom.

This article from news.com.au looks at some bedroom decor tips that could improve the quality of your sleep.

IT MIGHT not be high on your interior makeover list, but paying attention to decorating your bedroom has its benefits.

Appropriate bedroom design can have a lot of power over how well you rest.

Here are some easy ways you can decorate your room to help improve your sleep.

Bedding

It should go without saying that a bed itself has to be comfortable in order to get a good night’s sleep.

But you’d be surprised how many people fail to select bedding products that don’t work for them.

Your bed is something you should put good money towards, so expect to fork out a bit of money for the best quality bed.

Your mattress has to be comfortable, otherwise you’re going to have a Goldilocks issue with having a mattress either too hard or too soft.

Make sure you find out your sleeping style, desired support level and choose one to match this.

Colour

Cool tonal palettes are optimum in bedrooms and should be considered the next time you give your bedroom a fresh coat of paint.

A TraveLodge study looked at homes across the UK to determine if the colour of a bedroom can influence sleep.

The findings revealed that the most restful colour for a bedroom is blue, with people sleeping in blue bedrooms getting an average of five hours and 52 minutes a night

.

Sleep expert Chris Idzikowski said of the findings:

“There are specialised receptors called ganglion cells in the retina part of our eyes, which are most sensitive to the colour blue,” he said.

“These receptors feed information into an area deep in our brain that controls 24 hour rhythms, and affects how we perform and feel during the day.”

Cool, muted hues like blue, neutrals and greiges all create a serene and relaxing atmosphere.

Lighting

We all strive for natural light in our homes but the bedroom is an area where this could be to our disadvantage.

As we approach spring, the moving of the clocks forward may mean we get an extra hour of sunlight, but we also lose an hour of sleep.

So it’s important to block out as much natural light as possible in your bedroom to ensure you’re not disturbed.

This doesn’t mean you have to have cumbersome drapes, instead try installing roller blinds that have a blockout effect.

Technology

We’re told time and time again not to introduce technology into the bedroom but it seems to be something we still ignore.

According to research that explored the effect of bright screens used before bed, our melatonin levels (the hormone that helps us be ready for sleep) is affected by up to 1.5 hours of screen usage.

This increases our alertness and delays the body clock.

Life, One Night at a Time” is a call for people to reignite the romance with sleep.

Layout

Feeling balanced and centred in your bedroom is essential for a good night’s sleep.

Your layout must complement your sleep and there are certain ways to organise the furniture in your room in order to catch those Z’s.

A well-balanced bed is important for creating good feng shui in the room.

Your bed is the major feature of your room and should be easily approachable from both sides.

Click here for the full article

.

.

No comments:

Post a Comment