Record wealth

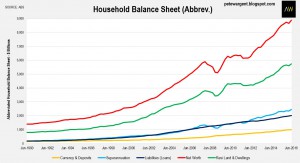

Land and dwellings drove the gains in household wealth this quarter, increasing by $112 billion, more than erasing declines in the preceding quarter of $58.5 billion.

Financial assets also increased in the June quarter, up by $90.8 billion, largely driven by improving superannuation and pension fund balances.

Australian household net worth increased by 2.7 per cent over the quarter and 5 per cent over the financial year to $8.89 trillion.

Cash and deposits increased to $997 billion or 22.4 per cent of financial assets, suggesting some reticence to spend and invest.

Of superannuation and pension assets, cash holdings are well above their long term averages.

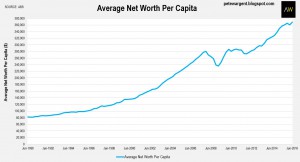

After accounting for household liabilities of more than $2 trillion, this takes the average net worth per capita close to ~$369,000.

Incredible by anyone’s measures.

Australians have never been wealthier.

Almost nobody in the world has for that matter.

Residential assets

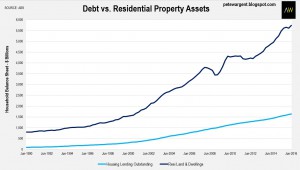

Not all residential property assets are owned by households, of course, but around $5.74 trillion worth are.

Thanks to interest rate cuts in May and August, the interest payable to income ratio declined to 10.3 per cent, and will decline again in the next quarter too.

This index is now a third below the June 2008 peak of 16.4 per cent.

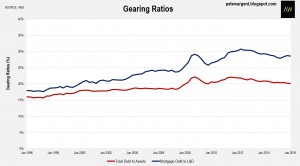

Finally, the ratio of mortgage debt to residential property assets declined to 28.6 per cent.

However, with fewer first homebuyers buying for cash and more incumbent owners drawing equity, this ratio is certain to rise over the next decade.

The ratio of total debt to total assets declined to 20.1 per cent.

The wrap

You can easily see the disruptive impact the macro-prudential controls had on the housing market towards the end of 2015 and in early 2016.

By June 2016, dwelling prices were rising again, and this has continued into the September quarter.

No comments:

Post a Comment