It’s time for our monthly check on how the property markets are performing around Australia, and looking back over the year they have generally surprised on the upside.

Here’s what Corelogic’s latest stats and graphs show:

- Combined capital city home values increased by 0.5% in October with values rising in all capital cities except for Adelaide and Hobart

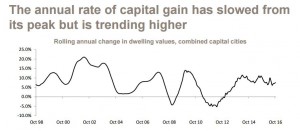

- The pace of growth has reduced when compared with previous months, with October dwelling values rising by 0.5%, compared with a 1.0% lift in September and 1.1% rise in August.

- Home values were 2.7% higher over the three months to October 2016 with home values in Adelaide, Perth and Hobart falling over the quarter

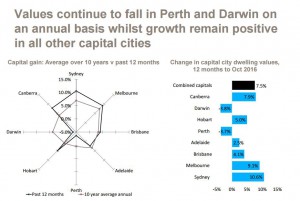

- Over the first ten months of 2016, capital city home values have increased by 9.1% and Perth and Darwin are the only cities in which values have fallen

- Over the past 12 months, combined capital city home values have increased by 7.5% which is trending up from a recent low of 6.1% at the end of July

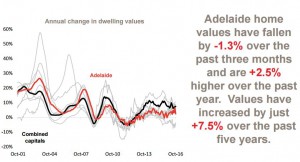

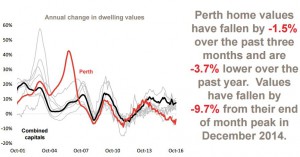

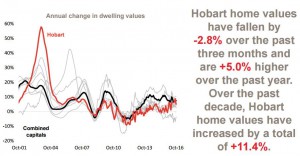

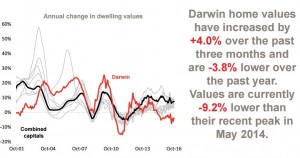

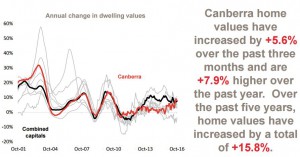

- Across the individual capital cities, the annual change in home values have been recorded at +10.6% in Sydney, +9.1% in Melbourne, +4.1% in Brisbane, +2.5% in Adelaide, -3.7% in Perth, +5.0% in Hobart, -3.8% in Darwin and +7.9% in Canberra

- Capital city house values have increased by 7.7% over the past year compared to a 6.3% increase in unit values

OUR PROPERTY MARKETS ARE FRAGMENTED:

As you can see in the following graphic capital city growth varies greatly, with the Sydney property market the strongest market in Australia again.

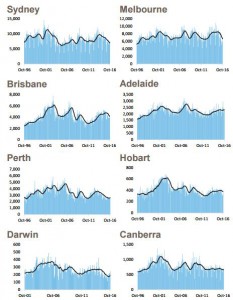

Settled home sales have begun to level over recent months

- Over the 12 months to October 2016 it is estimated that there were 323,000 houses and 128,461 units sold and settled nationally with house sales -15.3% lower and unit sales -14.9% lower over the year

- Across the combined capital cities there were an estimated 197,108 houses and 92,986 units sold over the 12 months to September 2016. House sales are -10.2% lower over the year while unit sales are down -15.3%

- It is important to note, the large volume of off-the-plan sales currently means there is a high likelihood unit sales volumes will be revised higher over the coming years, these properties will be entered into the database at their contract date but will not be available until they have settled.

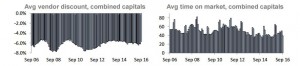

Selling time and discounting levels for homes have improved over the most recent month

- The typical capital city house is currently selling after 39 days compared to 36 days a year ago while the typical capital city unit takes 40 days to sell compared to 37 days a year ago

- The average level of discount is recorded at 5.8% for houses and 5.5% for units compared to 6.1% for houses and 5.6% for units 12 months ago

- Auction clearance rates have rebounded in 2016 and have been sitting at above 75% for the past nine consecutive weeks

New and total listings are lower than they were a year ago

One of the many reasons our property markets remain so strong is that there are fewer properties for sale at a time when demand form both owner occupiers and investors is still strong.

- Over the past 28 days there were 49,431 new homes listed for sale nationally and 31,264 of these were listed across the capital cities

- New listings are -2.8% lower than they were a year ago nationally and -4.1% lower across the combined capital cities

- There were 238,773 total listings nationally over the past four weeks and 109,814 total capital city listings

- Nationally, total listings are -2.6% lower than a year ago while they are 2.0% higher across the combined capital cities

- In Sydney, Hobart and Darwin in particular there a significantly fewer new listings than there were at the same time a year ago while in Brisbane and Perth there are substantially more new listings

Despite APRA’s best efforts, investors are still very active in our markets…

WHAT’S HAPPENING AROUND THE STATES?

Despite a slight retracement at the beginning of the year, Sydney’s price growth has resumed at a much more sustainable level and Sydney’s property market will deliver double digit growth this year.

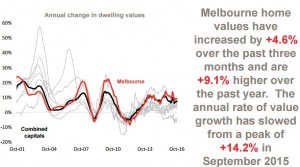

The Melbourne property market performed strongly over the last 12 months, underpinned by strong population growth (around 1.8% per annum) and a relatively strong economy creating more jobs.

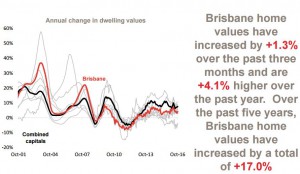

Brisbane’s property market has confounded those “hot spotters” who were predicting it to be the place to be this year.

Brisbane recorded an 0.8 percent rise in dwelling values in October taking the annual pace of capital gains to 4.1 percent that’s well below the combined capitals a

This has in part been dragged lower by weaker performance of unit market across Brisbane (-1.4% over the year.).

While overall growth is sluggish, the Brisbane market is very fragmented and there are still some areas that are performing respectably and have good investment prospects.

On the other hand there is a significant oversupply of new high rise off the plan apartments overshadowing the inner city area and nearby suburbs.

Approximately 49,000 units that have been approved for construction across the broad Brisbane metro region.

While it’s unlikely that all projects will proceed through to commencement, based on these approval numbers across Brisbane, the inner city Brisbane apartment market is one to stay clear of.

The Adelaide property market has stalled after its little flurry at the beginning of the year and home values recording a 2.4% fall over the month

The Perth property market is still in its slump phase with a significant oversupply of properties for sale and values still falling.

Similarly the oversupply of rental properties in Perth is causing rents to fall.

There is still some considerable downside to the Perth market as it works its way through the excesses of the mining boom:

Similarly there are few growth drivers for Hobart property prices, and even though some commentators have been suggesting it’s a good place to invest “because it has to catch up”, with minimal population growth and slow economic growth there seems little reason for property values in Hobart to grow substantially.

Despite an early growth spurt at the beginning of the year, Hobart has underperformed over the last decade with property prices only increasing 11.1% over the last 10 years.

Darwin property values are lower than they were 12 months ago, and like Perth, I believe there is more down side yet to come.

The Canberra property market has performed better than many other locations this year:

Economic data remain mixed.

Here’s a summary of the major economic factors impacting our real estate markets:

- The latest CPI data for September 2016 shows that despite two interest rate cuts earlier this year, inflation remains stubbornly low and below the RBA’s target range

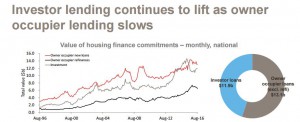

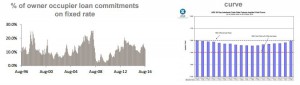

- New lending to both investors and owner occupiers has fallen from recent peaks with investor lending recording a much greater decline however, investment lending increased in August as owner occupier lending slowed

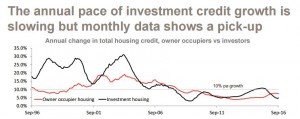

- Total housing credit is rising and although annual investment credit growth has slowed and is now well below APRAs 10% threshold for annual growth, monthly data shows growth in investor credit has picked-up over the past five months

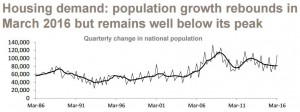

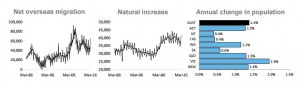

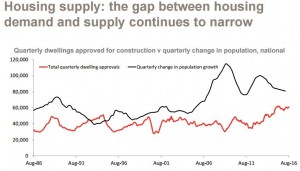

- The rate of population growth at a national level is lower than recent highs but has steadied over recent quarters thanks to improving net overseas migration

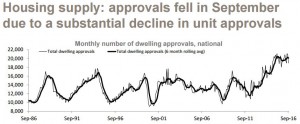

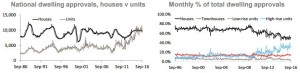

- Dwelling approvals fell in September, dragged lower by units however approvals remain high on an historic basis

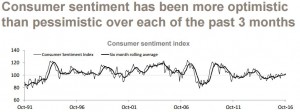

- Consumer sentiment remains at a fairly neutral setting although it has been more optimistic than pessimistic for three consecutive months

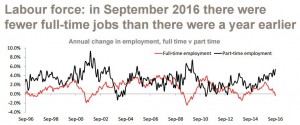

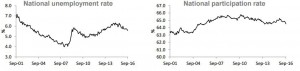

- The unemployment rate was recorded at 5.6% in September although employment growth over the past year has exclusively been driven by part-time job creation

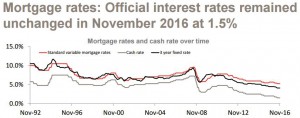

- The Reserve Bank left official interest rates on hold at 1.5% in November 2016

- Commodity prices remain well below their previous peaks however, they have increased by 29% since January of this year

The following two graphs show the correlation between consumer sentiment and our housing markets:

Employment security and new job creation are important factors for consumer confidence and the strength of our property markets.

Currently we are creating fewer full time jobs and more part time jobs that 12 months ago:

Interest rates remain at historic lows, but now there is concern that American interest rates could rise with the election of Donald Trump as president elect and this could mean that the anticipated further fall in Australian rates next year may not eventuate.

In fact it’s now more likely rates will rise in the medium term.

Source of graphs and statistics: Corelogic

WHAT CAN YOU DO TO STAY AHEAD?

If you’re looking for independent advice, no one can help you quite like the independent property investment strategists at Metropole.

Remember the multi award winning team of property investment strategists at Metropole have no properties to sell, so their advice is unbiased.

Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

Please click here to organise a time for a chat. Or call us on 1300 20 30 30.

When you attend our offices in Melbourne, Sydney or Brisbane you will receive a free copy of my latest 2 x DVD program Building Wealth through Property Investment in the new Economy valued at $49.

No comments:

Post a Comment