Saving for your first home is getting harder!

According to a recent article in the Domain if you saved 40 per cent of your income from today, it would take until 2021 to purchase your first home.

And that’s provided property prices don’t rise, rents don’t increase, and you maintain an $80,000 salary.

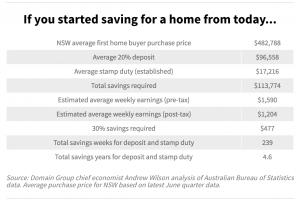

Considering the cost of a 20 per cent deposit and stamp duty on an average first-home buyer purchase, it would take more than 4½ years to have enough to buy, according to Domain Group chief economist Dr. Andrew Wilson.

He says they’d need to save 39 per cent of their after-tax income – $477 a week – leaving about $725 a week for all expenses, including rent.

Even those putting close to $500 aside a week likely won’t be able to buy before 2020.

After saving this amount for close to five years, provided prices had not increased in half a decade, you’d be able to afford a modest home under $500,000 – likely an older one – or two-bedroom apartment in a middle-ring suburb, such as Parramatta or Westmead.

House buyers would be looking 55 kilometres west of Sydney or on the Central Coast.

Source: Domain

Even this is unrealistic

Given this doesn’t factor in any increases in the property price post-June 2016, or increases in rent and living cost that outstrip any pay rises, it’s likely even this figure is optimistic, Dr Wilson said in Domain.

“In reality, if you started saving today it would more likely take you seven years,” he said, anticipating rental costs would increase by more than 10 per cent over this time.

“It would take a lot of sacrifice, you wouldn’t be able to go on holiday or buy a new car,” he said.

“Instead it’s likely more will see [saving a deposit] as insurmountable and it’s creating an environment of full-time renters.”

But there is an alternative – Rentvesting

Rather than buying a home first many people are turning to rentvesting.

In fact, Mortgage Choice’s latest investors survey revealed 36.6 per cent of investors were first time buyers – up from 21.1 per cent at the same time last year.

Australians increasingly want to live close to work and where the action is, which is why most people like to live close to the capital city centers, but of course, with prices rising across most capital cities, purchasing property near or close to the city is becoming increasingly difficult for buyers — especially first home buyers.

The increasing appeal for younger generations to rent in desirable locations (where they can’t afford to buy) and buy an investment property where they can afford to but don’t want to live, is behind this sentiment shift to buying an investment property before their first home.

This trend, described as “rentvesting” suits the lifestyle of many millennials, allowing them flexibility in where they live, giving them the opportunity to travel and at the same time grow their wealth.

Interestingly this shift could mean the official statistics showing record low first home-buyer activity probably understates the real buying activity of young Australians as rentvestors purchasing investment properties wouldn’t be documented as a first-home buyer in the data, thereby skewing the figures.

Interestingly buying an investment property first may help you achieve your ultimate goal of owning your dream home in the future.

To learn more about the benefits of Rentvesting please read this blog: RENTVESTING – IS IT BETTER TO RENT & INVEST OR BUY YOUR HOME YOU FIRST?

No comments:

Post a Comment